The costs of decarbonisation

The costs of decarbonisation Bruno Prior Fri, 11/12/2020 - 02:35The following draft report is written on behalf of Summerleaze Ltd (backers of C4CS). The initial purpose was as a supporting document to a submission to an enquiry by the Commons Select Committee on Business, Energy and Industrial Strategy (BEIS). But it has a separate life, to demonstrate the capabilities and limitations of C4CS's Future Scenarios model. As such, it will hopefully be updated and expanded sporadically to consider alternative scenarios and as capabilities are added to the model.

The first version considered variations on one decarbonisation scenario that seemed to be the political focus for 2030 at the time: the partial electrification of heat and transport combined with further decarbonisation of electricity generation.

The latest version of the report is available to download as a 30MB PDF by clicking on the button below.

Download PDF version of report

The model can be accessed freely at the time of writing at https://ed.c4cs.org.uk/edfutscen. If you scroll to the bottom, there is a button to load a scenario. If you click on the following button, you can download (as a JSON file) the default version of the scenario explored in Section 3, for loading into the model and trying your own variations.

Download JSON file of default scenario for Section 3

Table of Contents

- Introduction – Our Experience

- Design

- Electrification

- Introduction

- Inputs

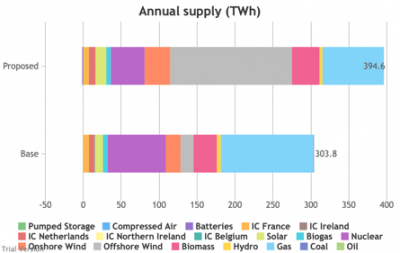

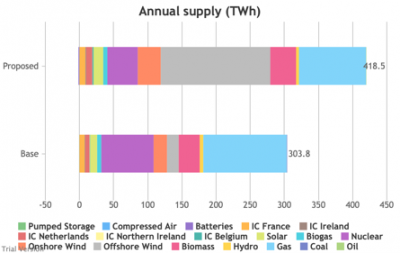

- Outputs

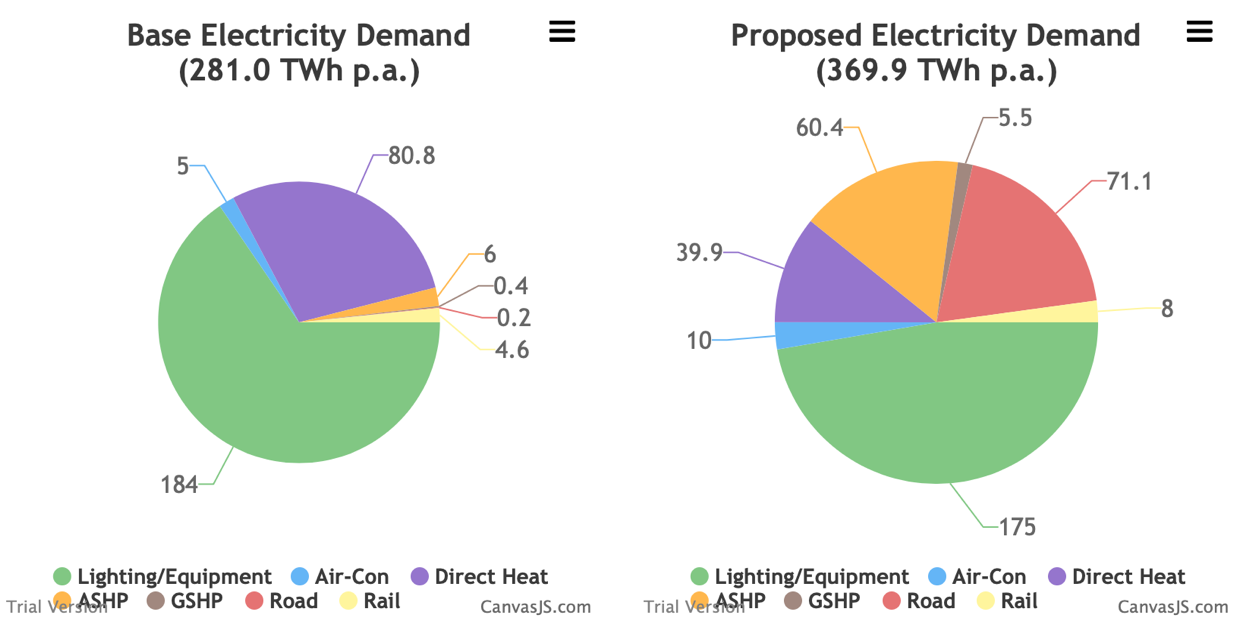

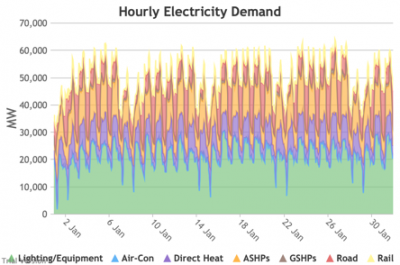

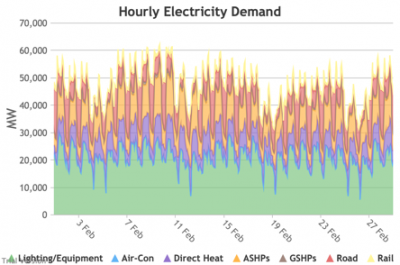

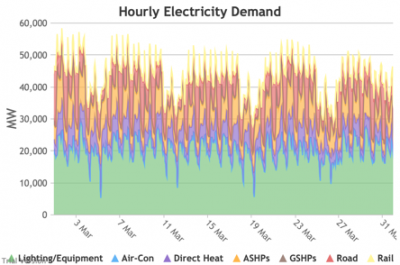

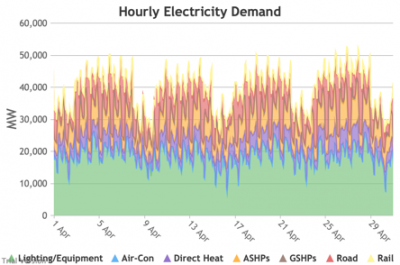

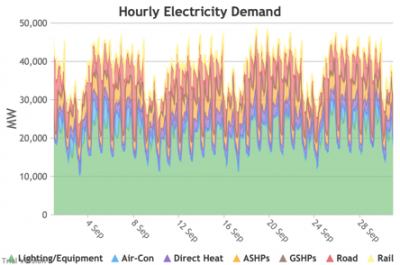

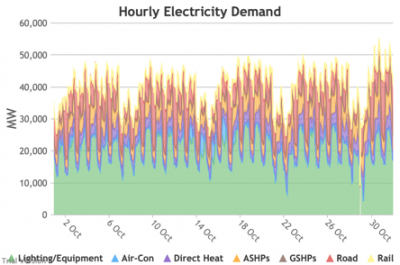

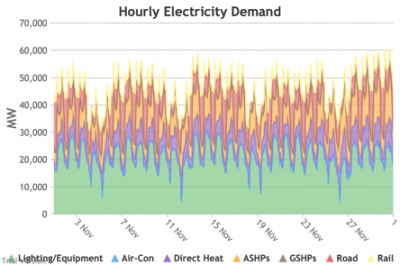

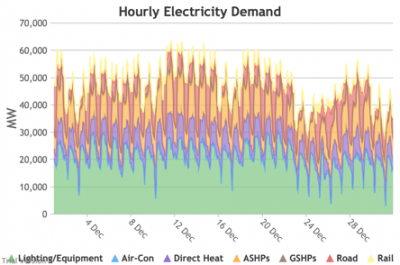

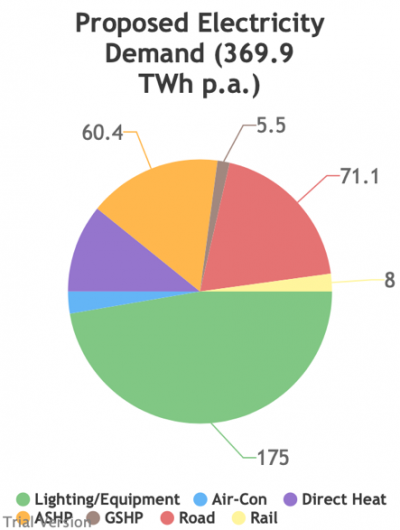

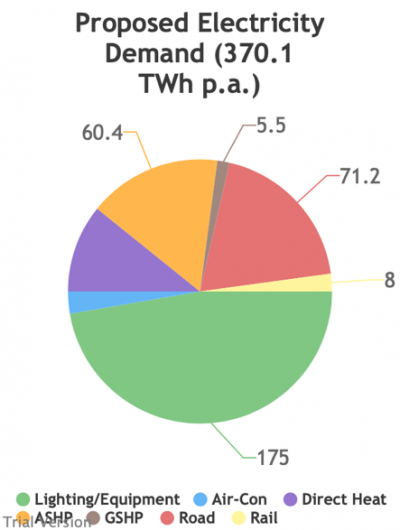

- Retail electricity demand (2017 base vs this scenario)

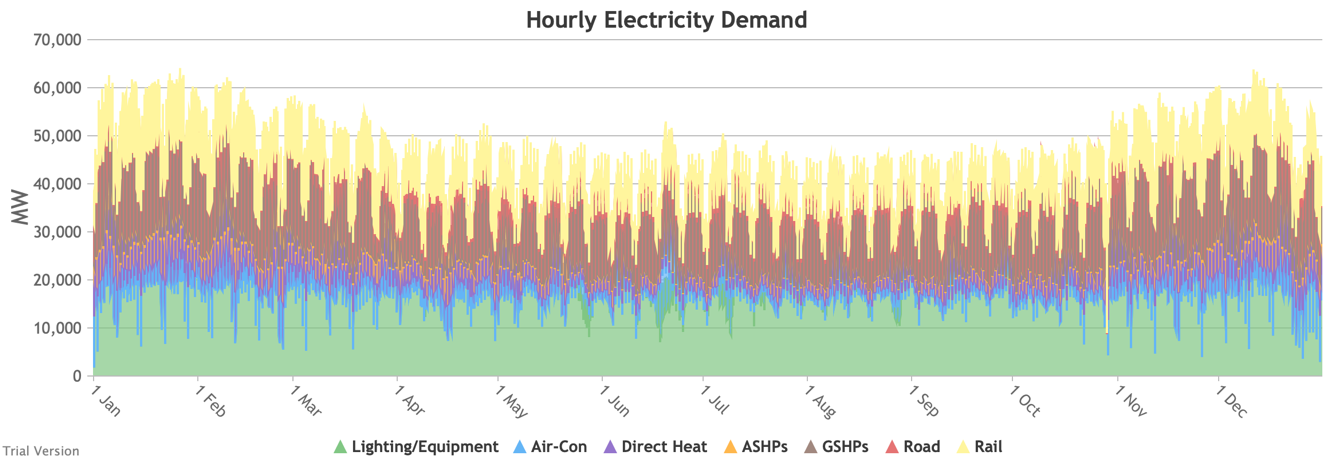

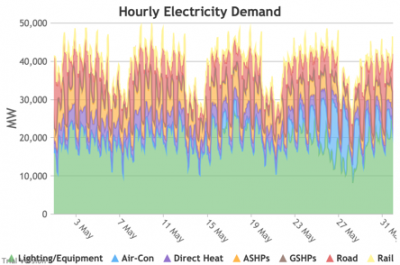

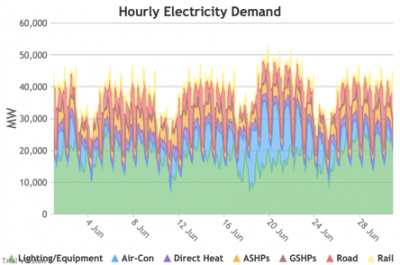

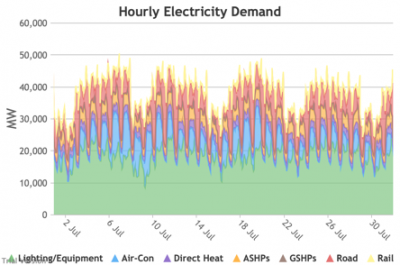

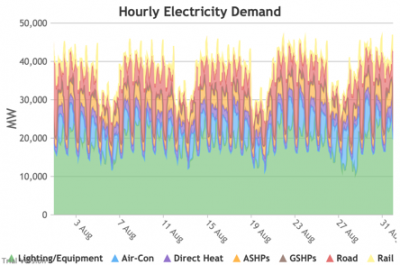

- Retail electricity demand profile

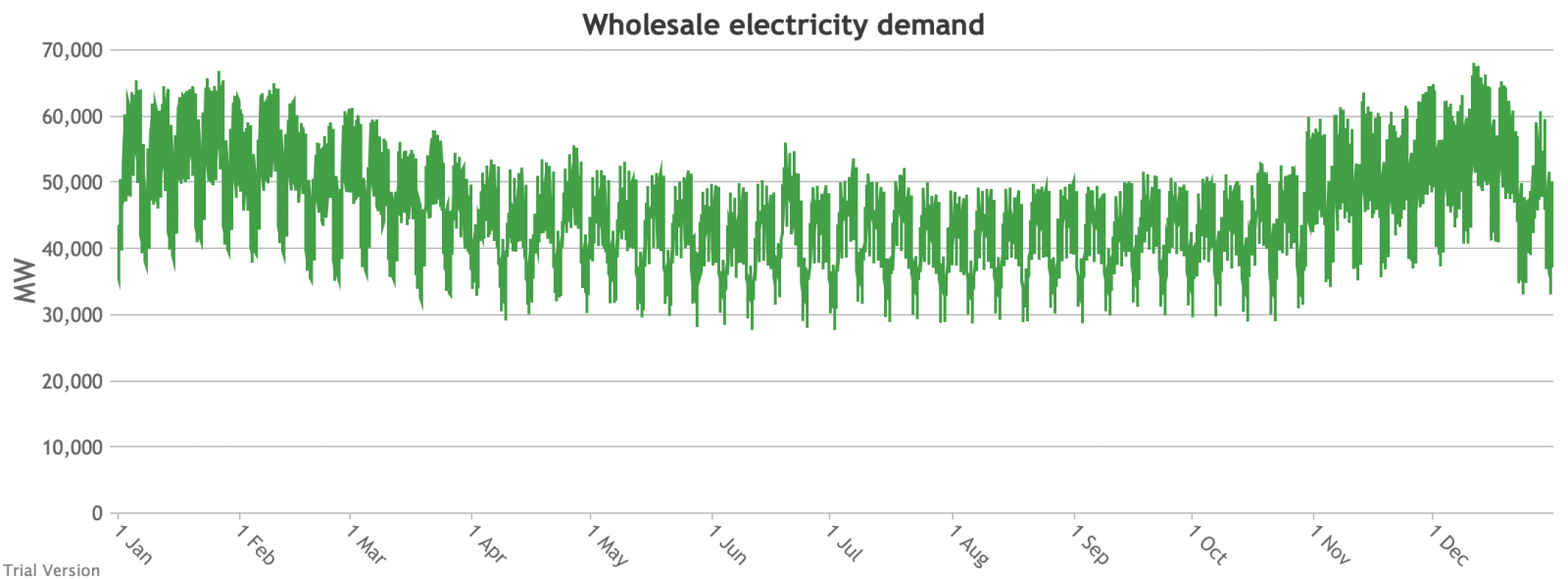

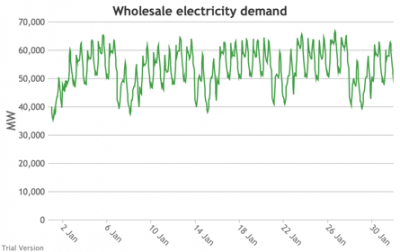

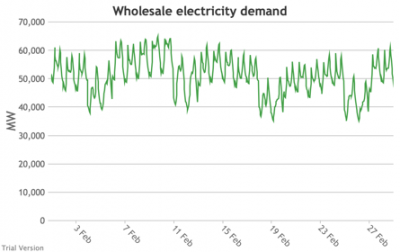

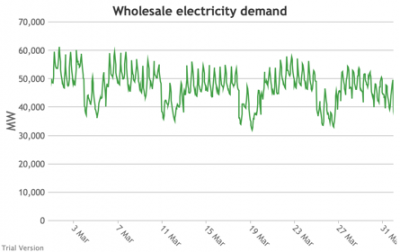

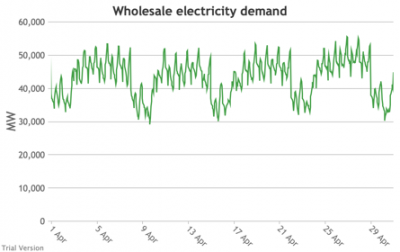

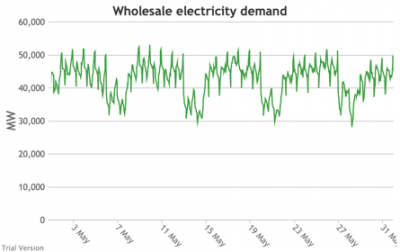

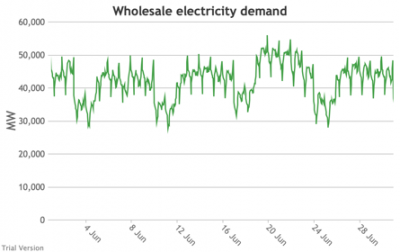

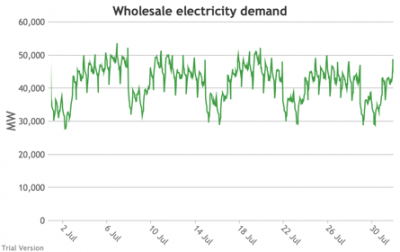

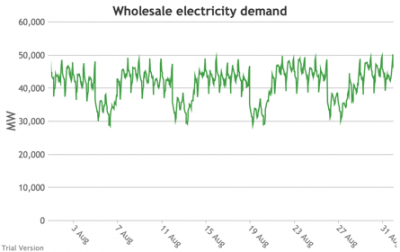

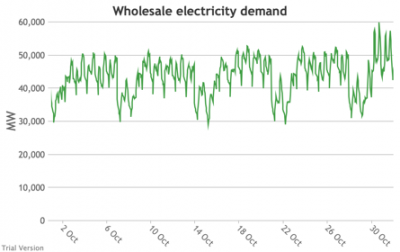

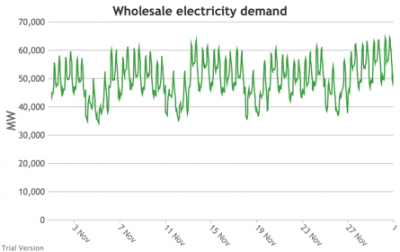

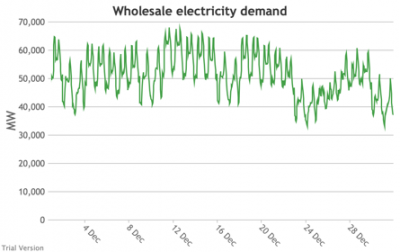

- Wholesale electricity demand profile

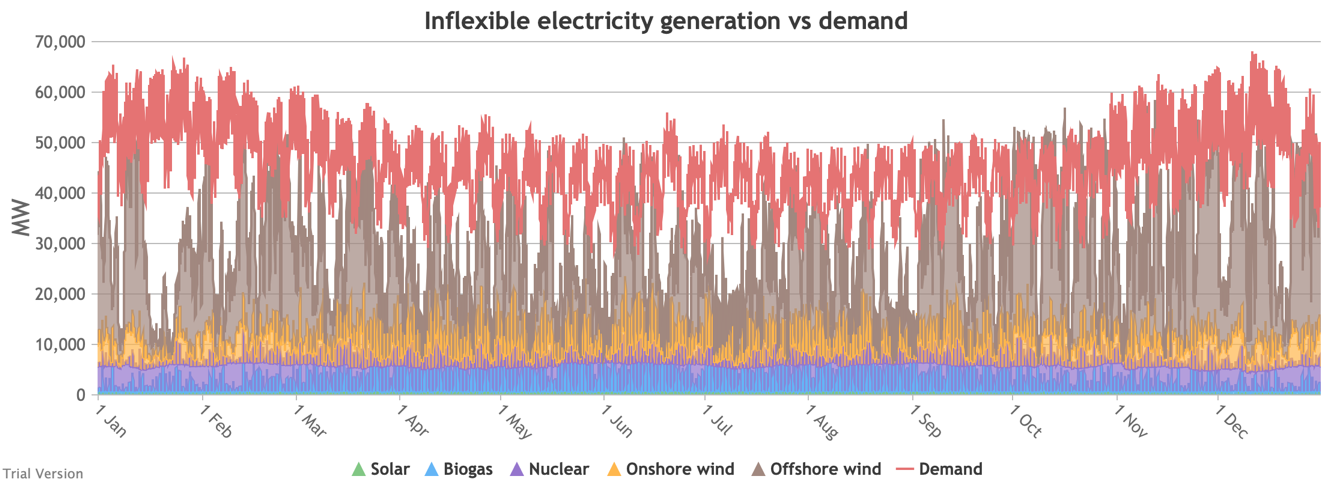

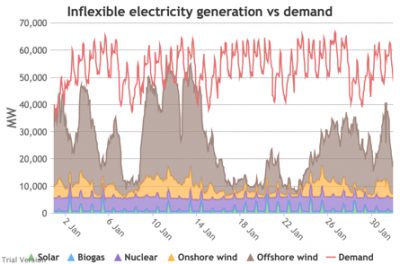

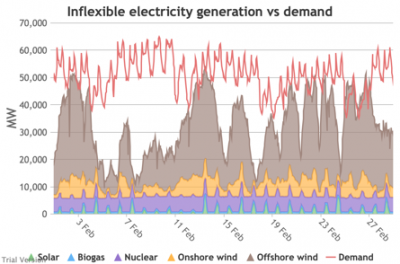

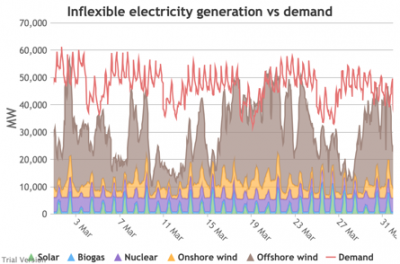

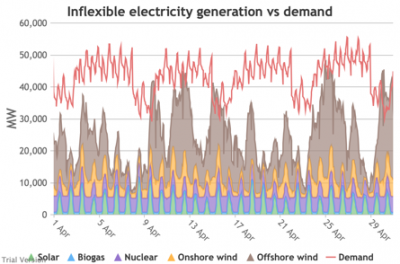

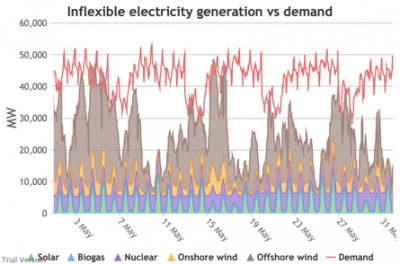

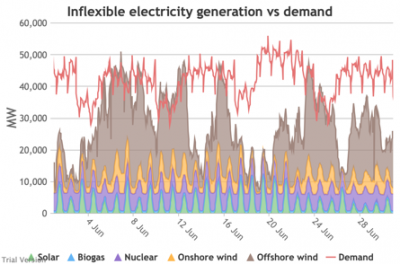

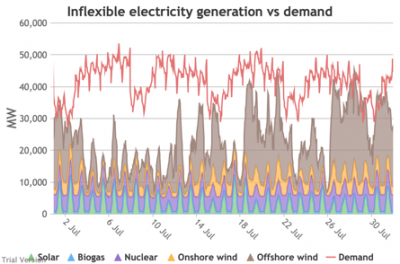

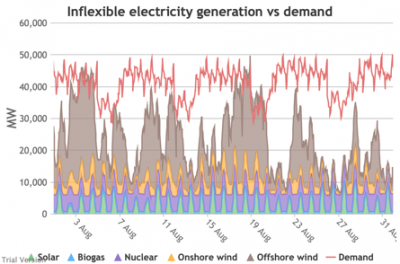

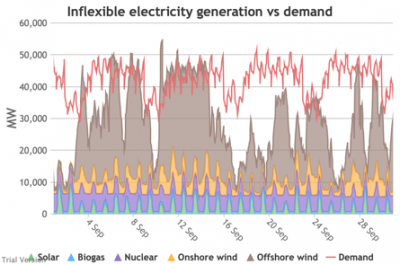

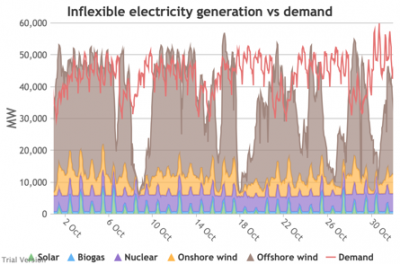

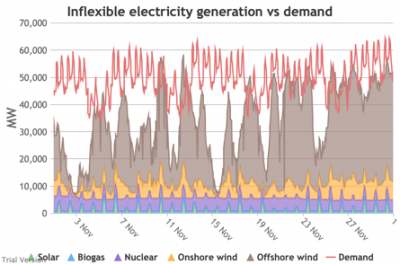

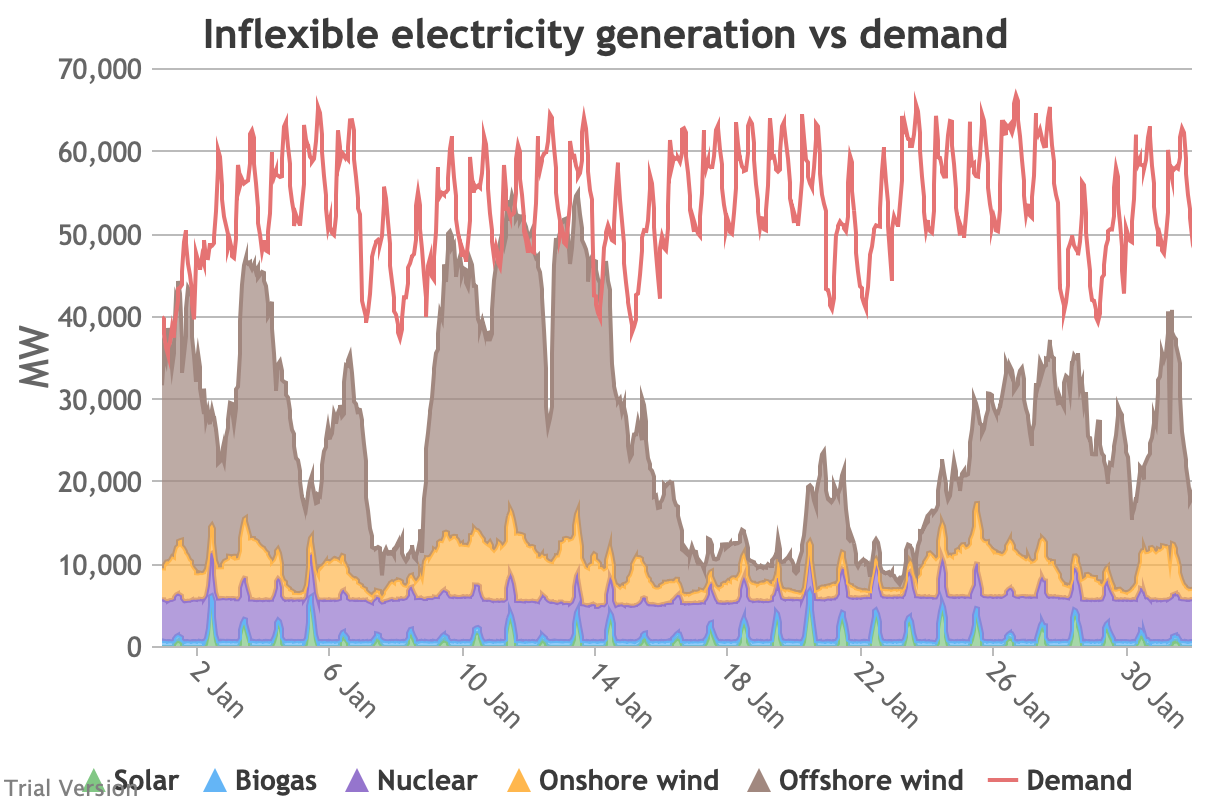

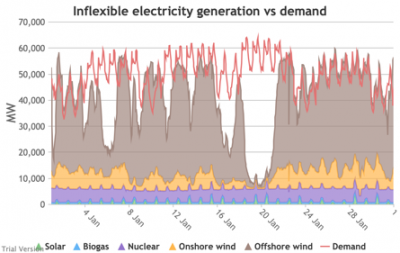

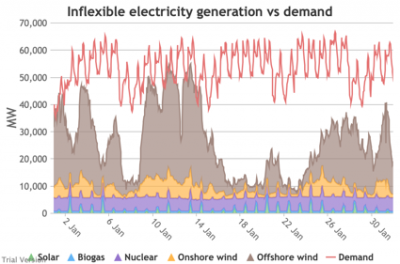

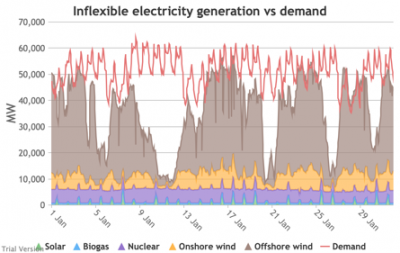

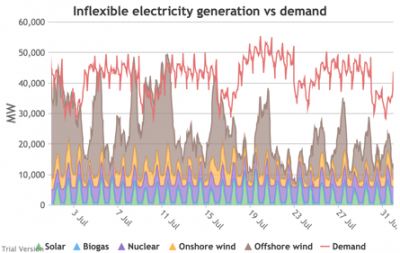

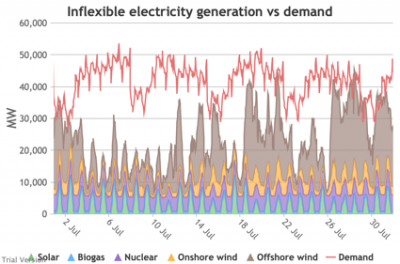

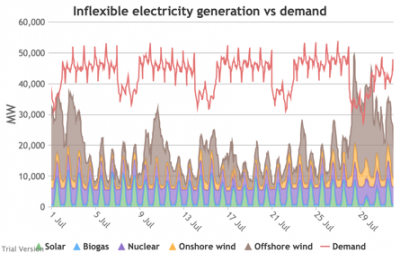

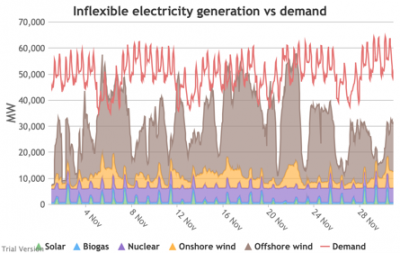

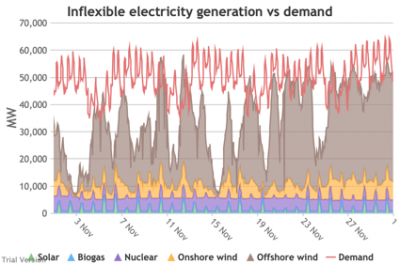

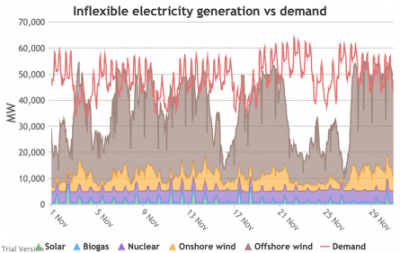

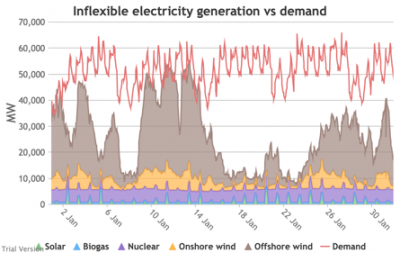

- Wholesale demand profile vs output from inflexible generators

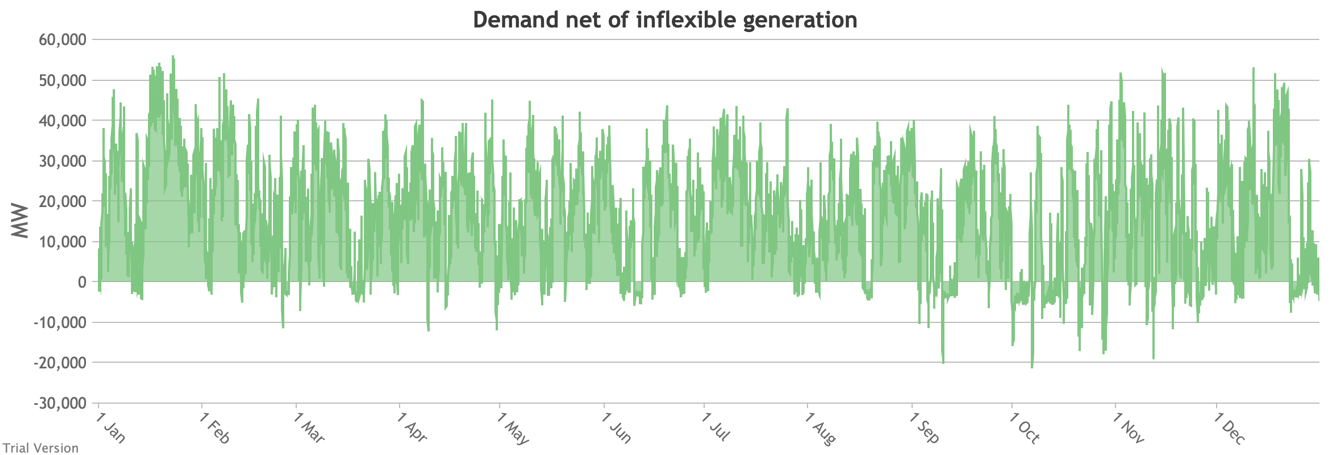

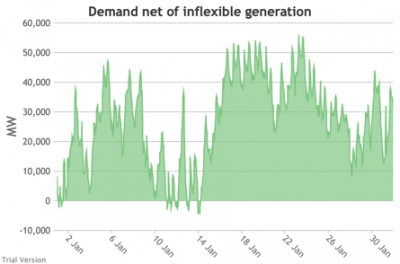

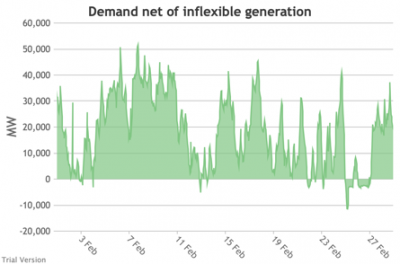

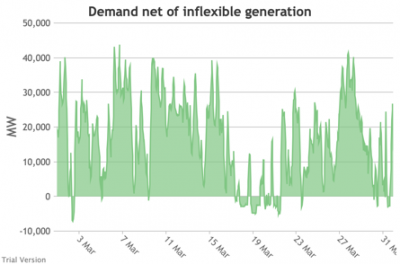

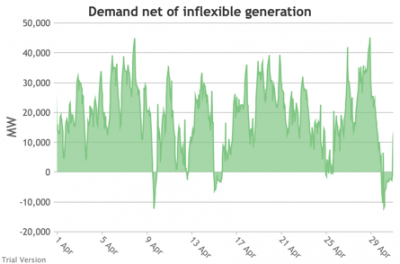

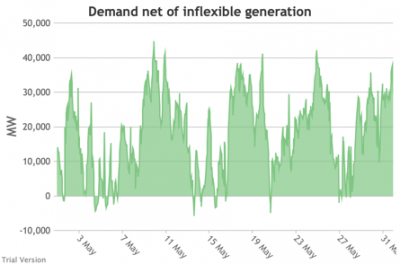

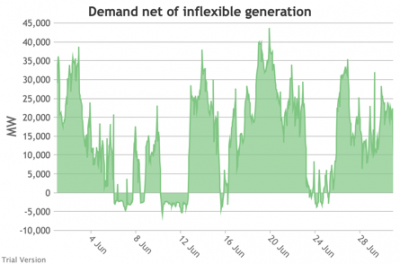

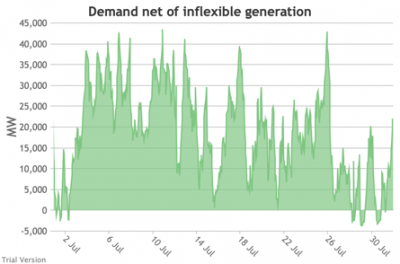

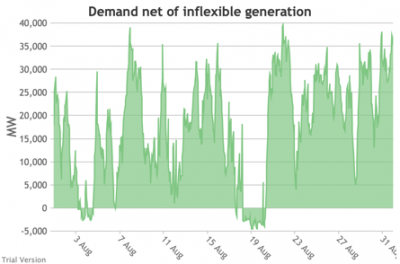

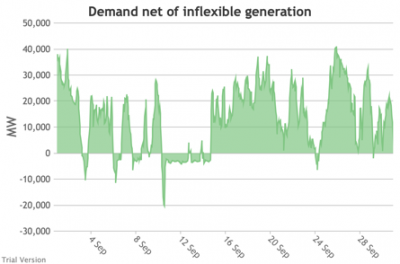

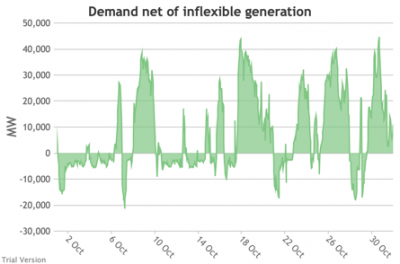

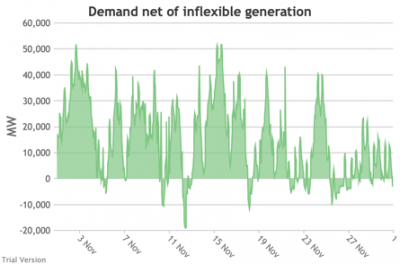

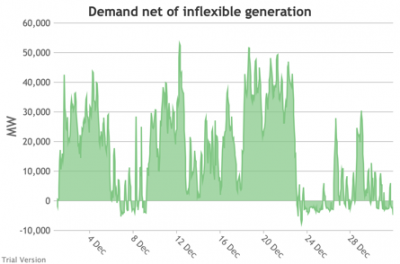

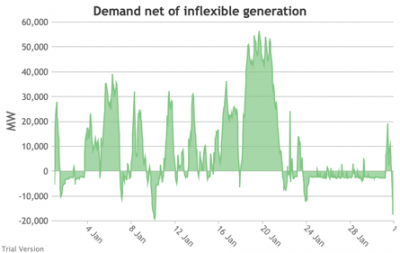

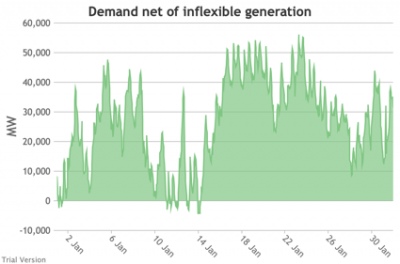

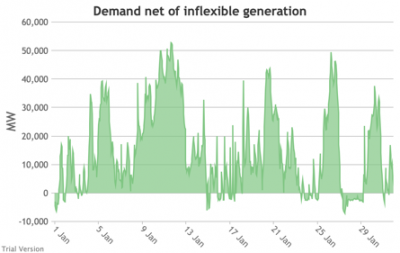

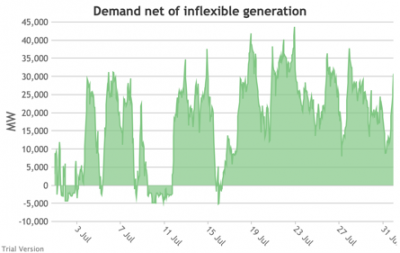

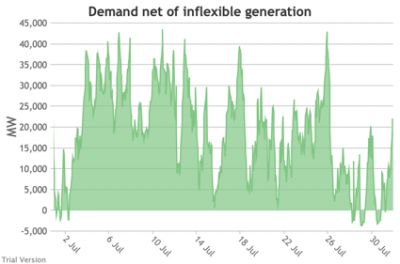

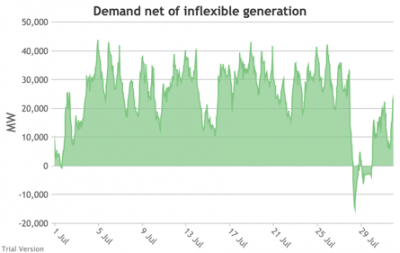

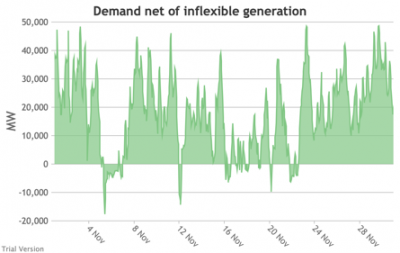

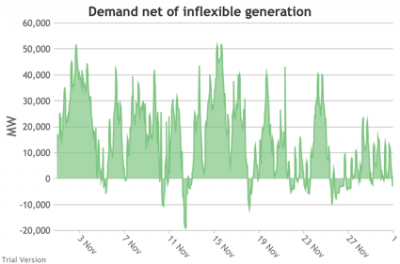

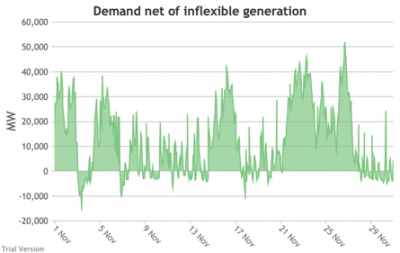

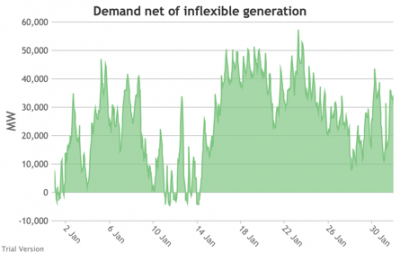

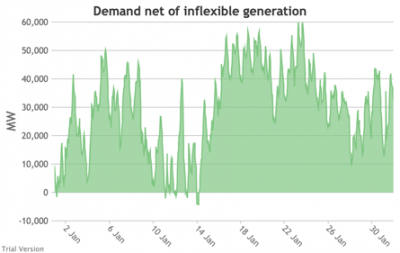

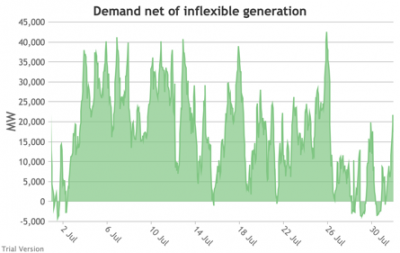

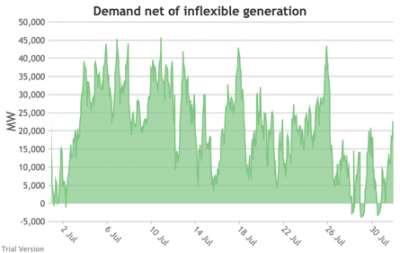

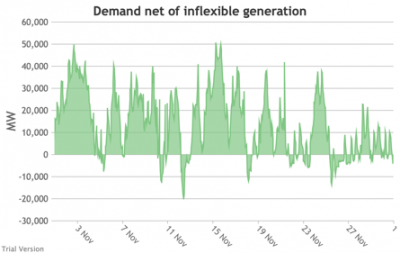

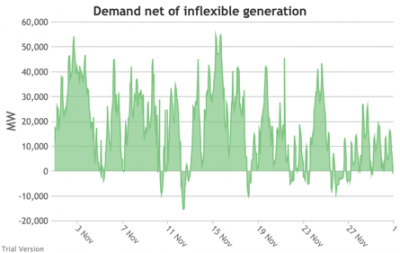

- Wholesale demand net of inflexible generation

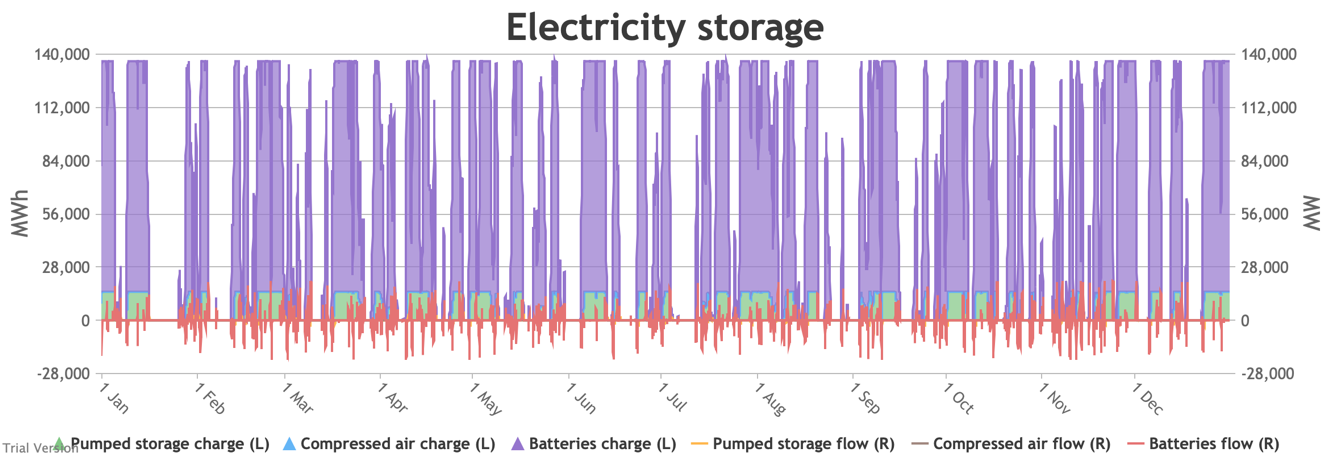

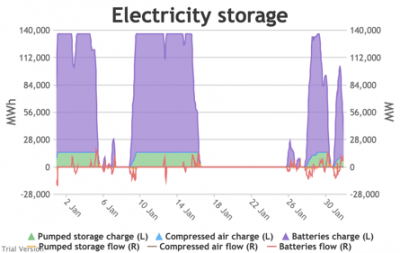

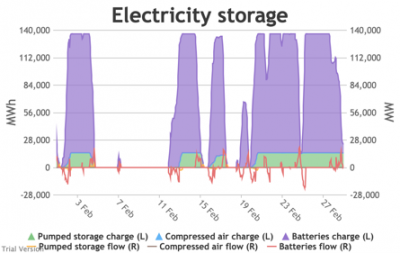

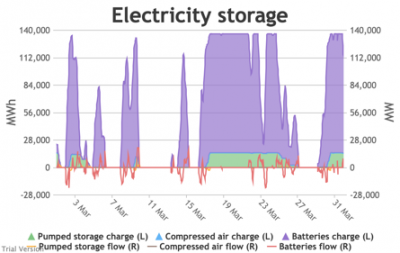

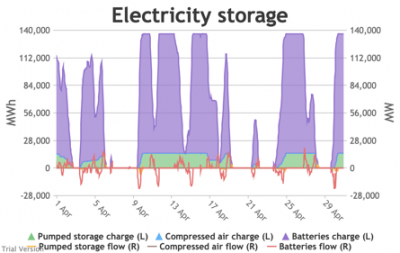

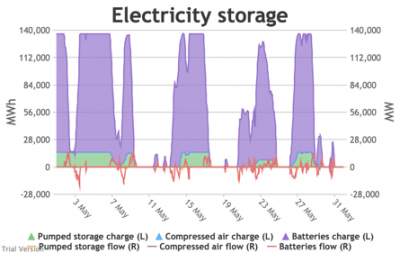

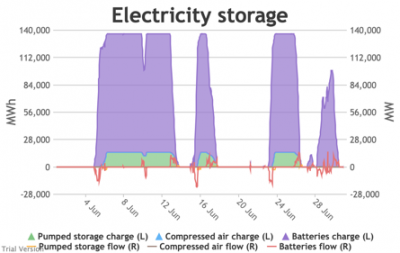

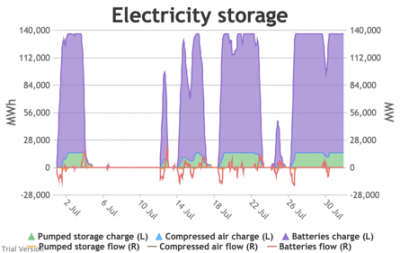

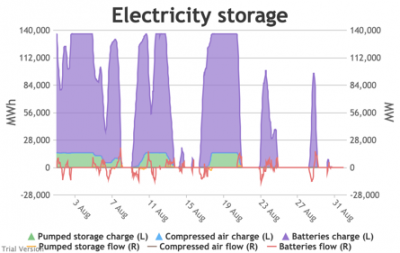

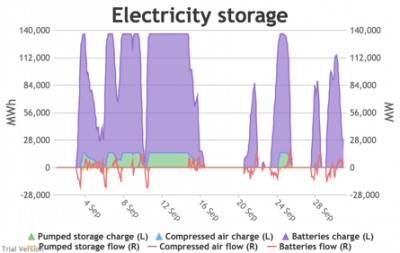

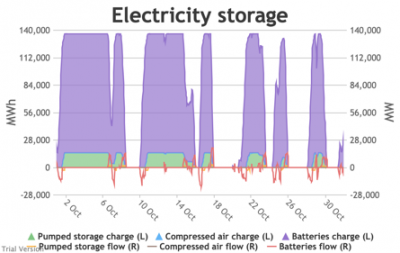

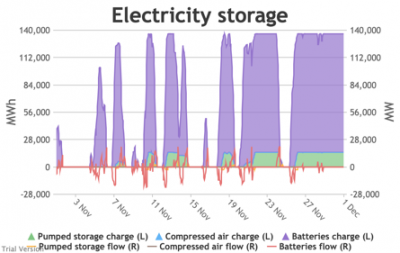

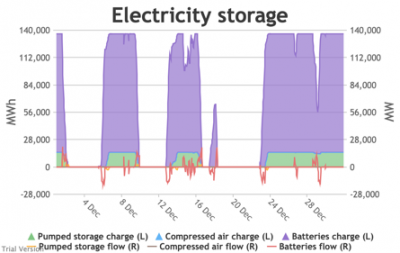

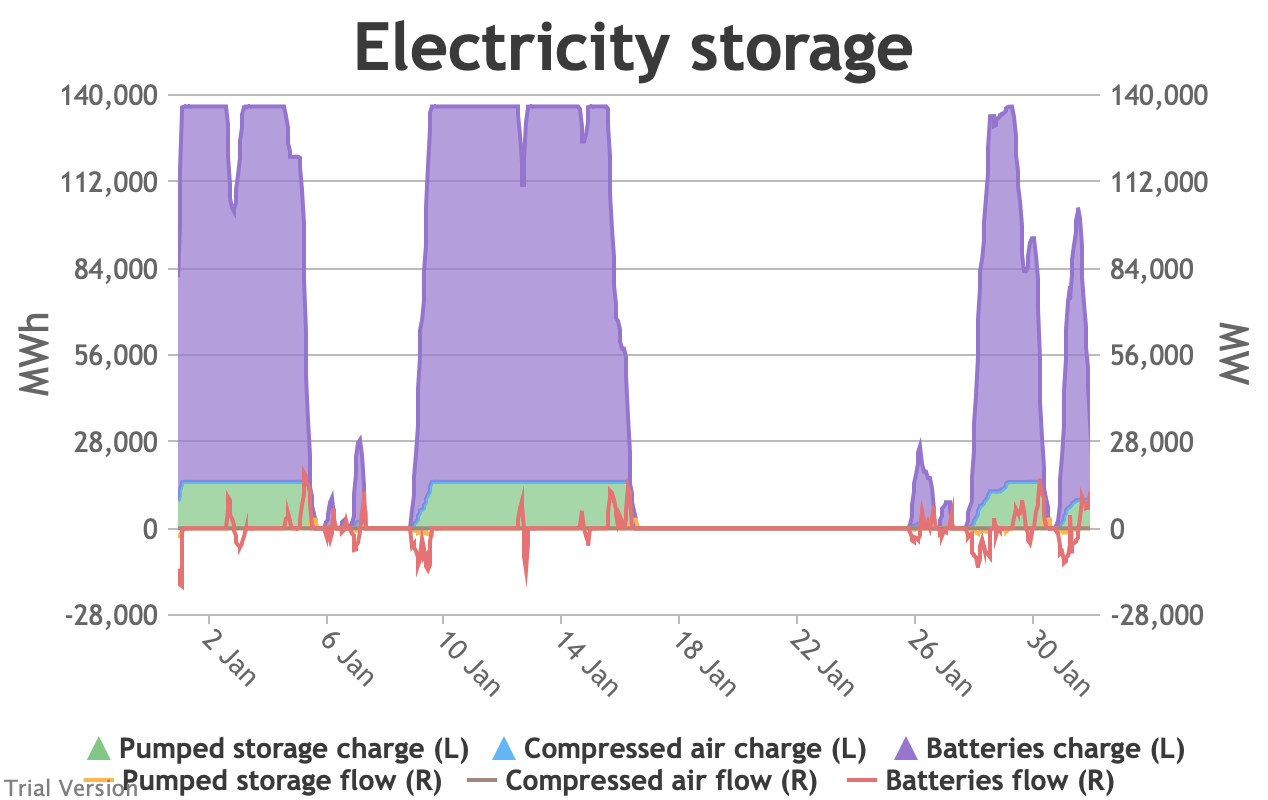

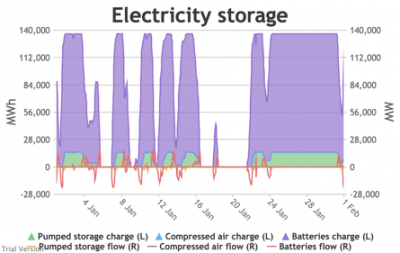

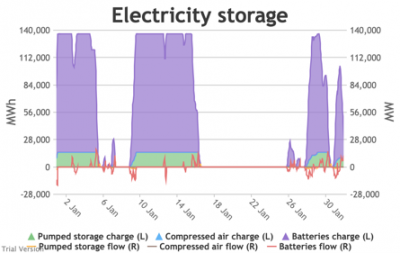

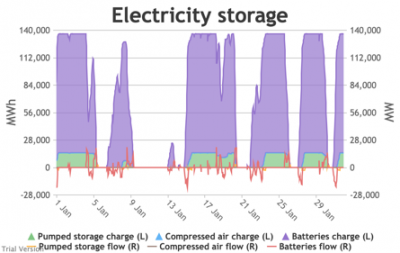

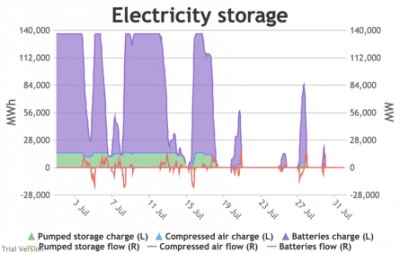

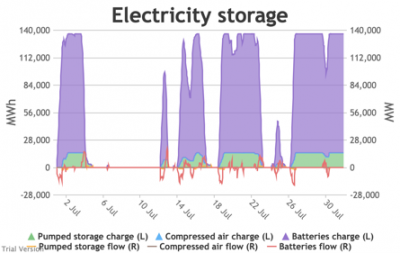

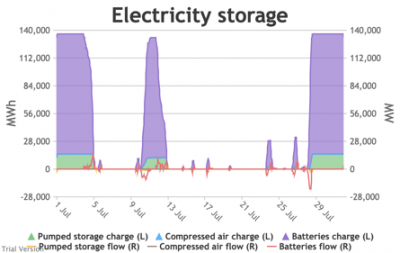

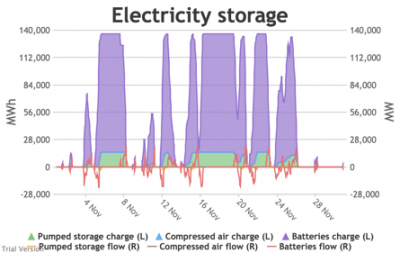

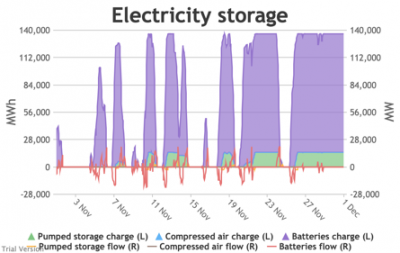

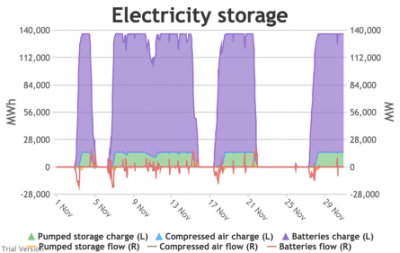

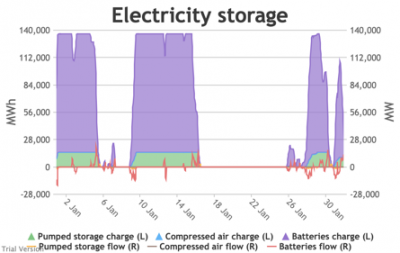

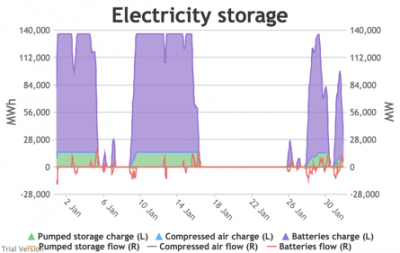

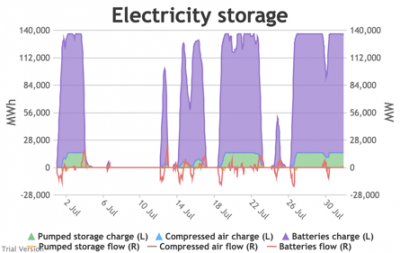

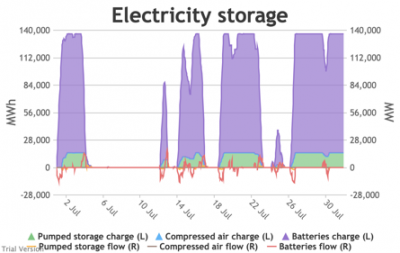

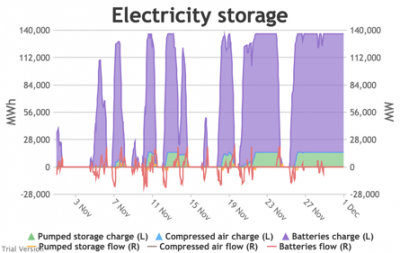

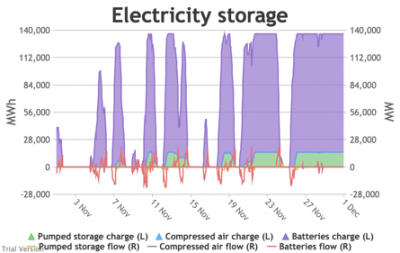

- Electricity storage flows and level of charge

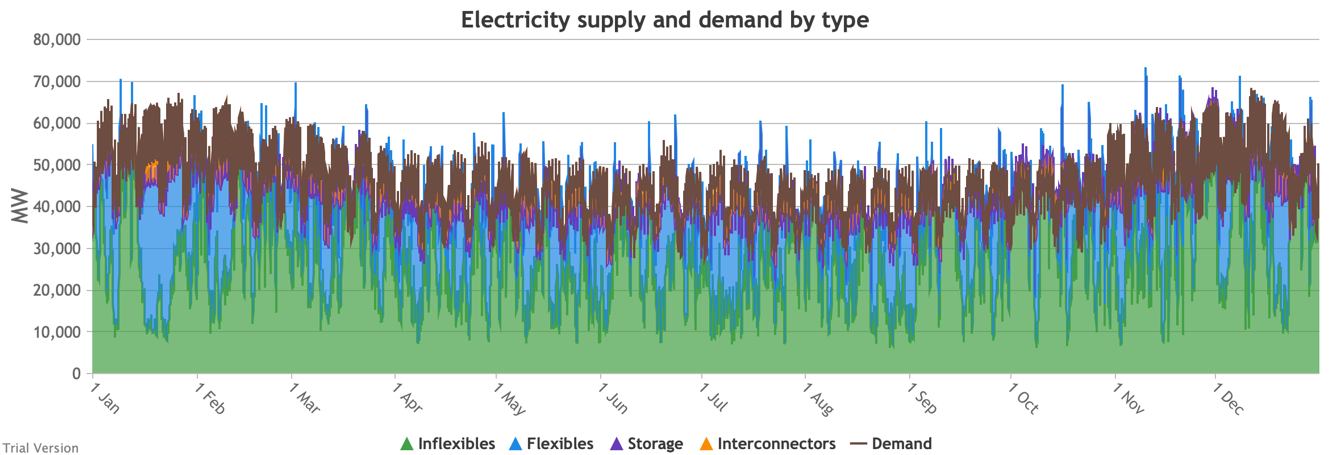

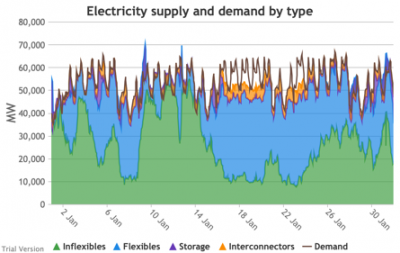

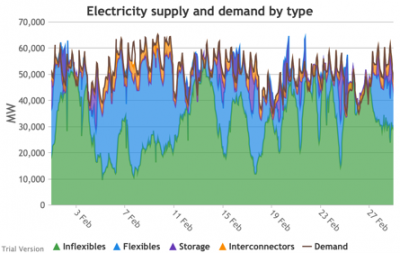

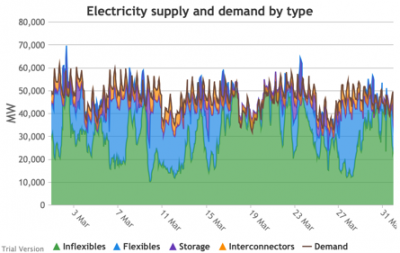

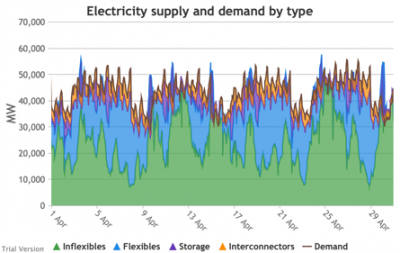

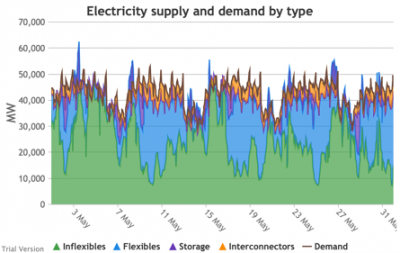

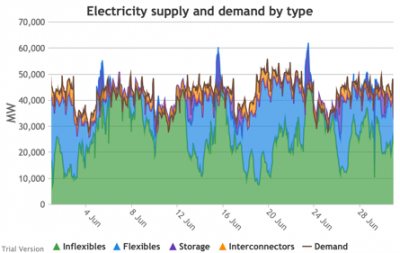

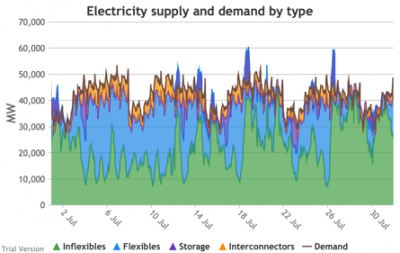

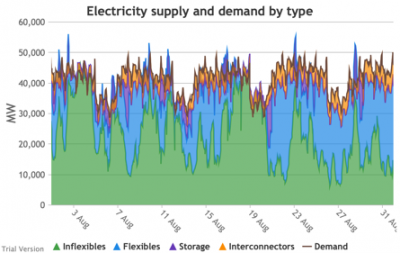

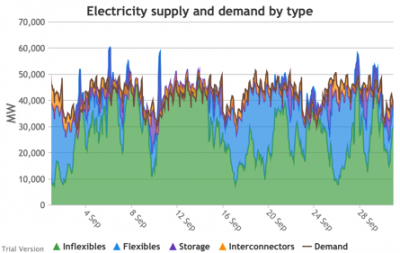

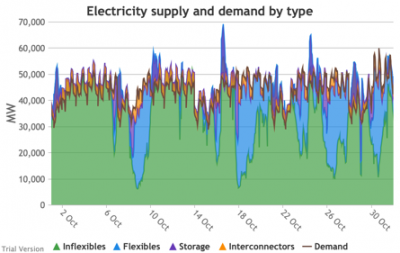

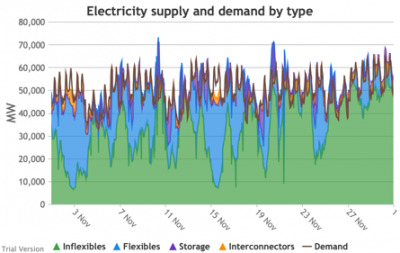

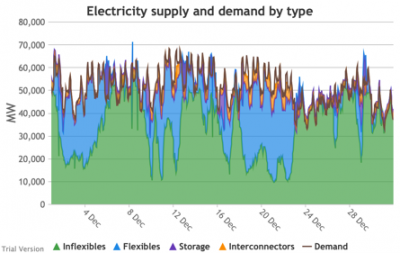

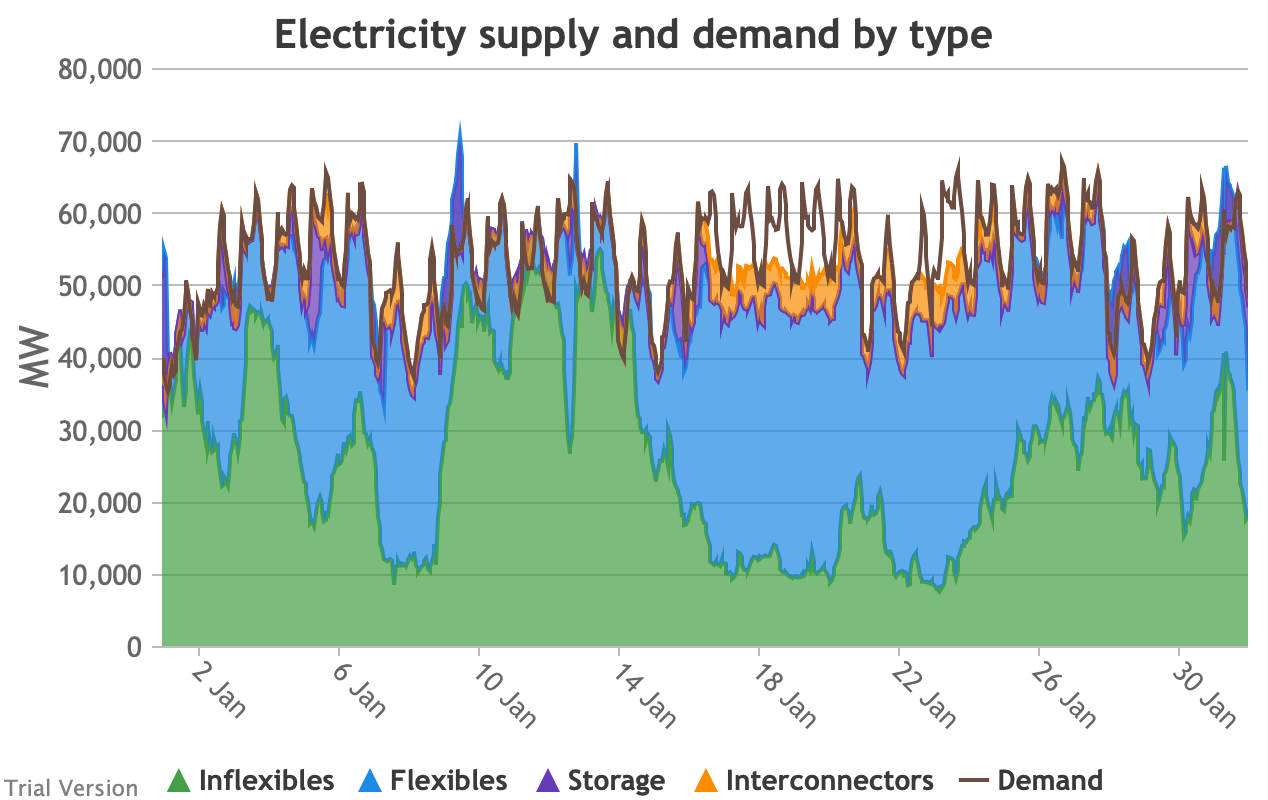

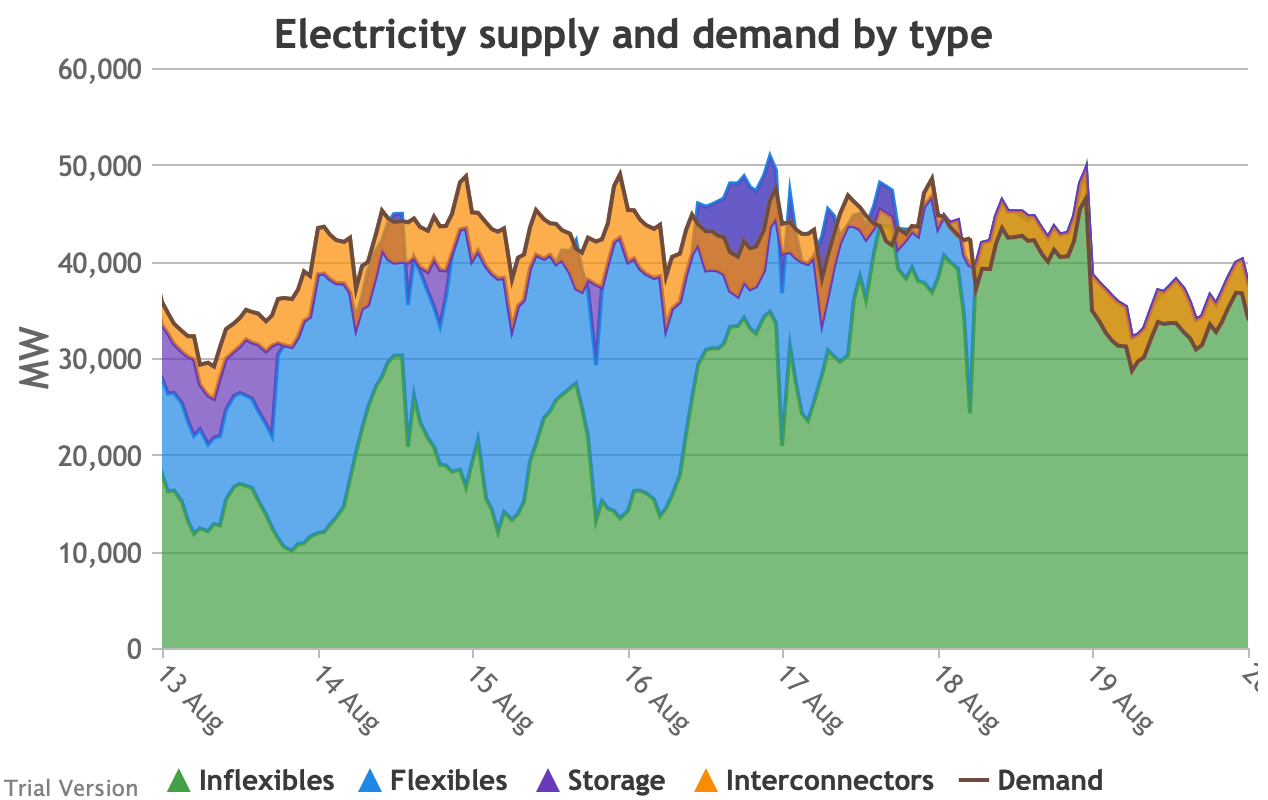

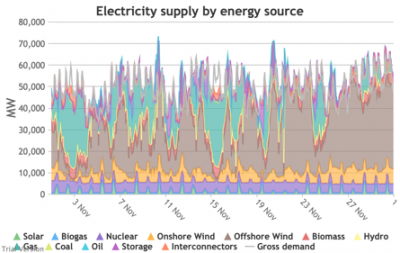

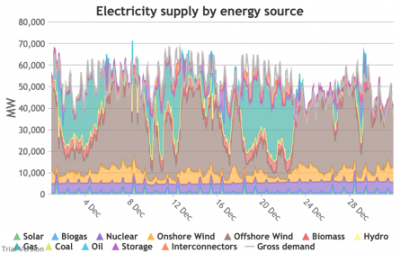

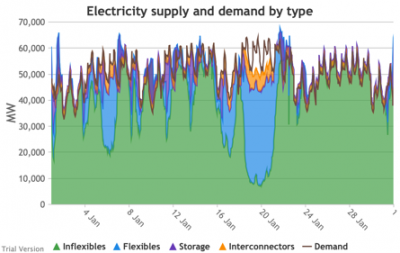

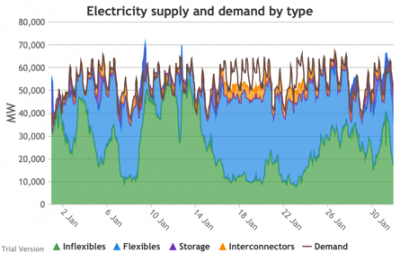

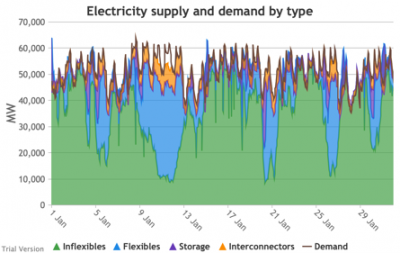

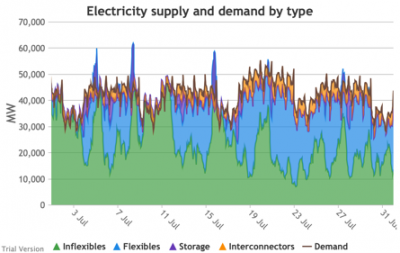

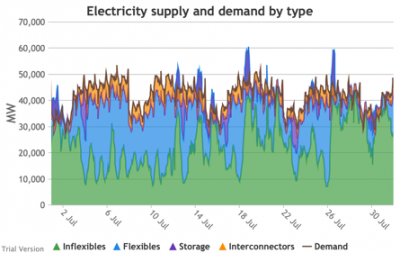

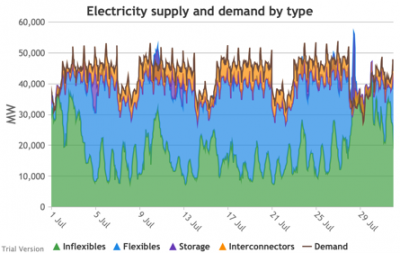

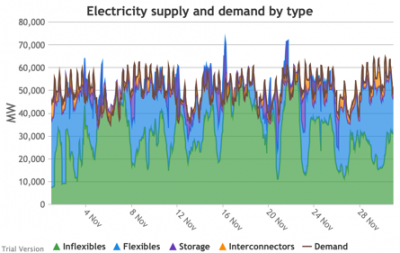

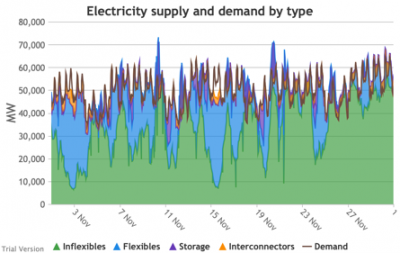

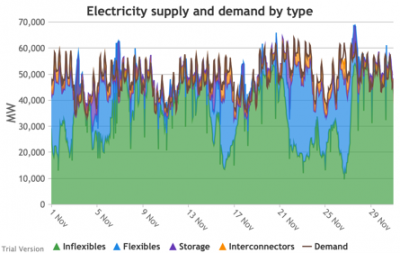

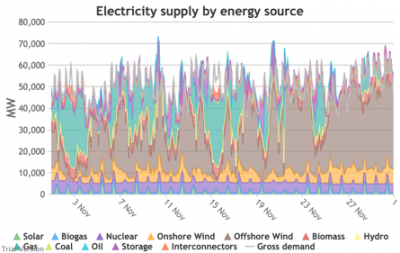

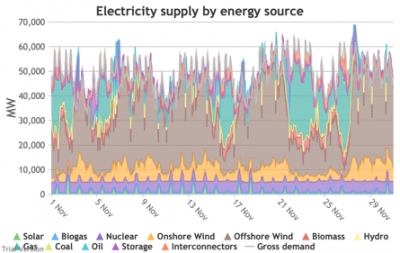

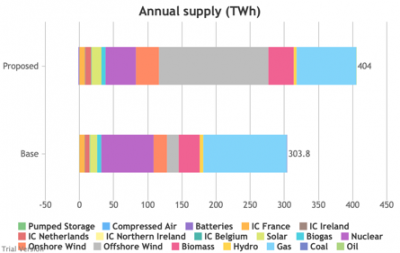

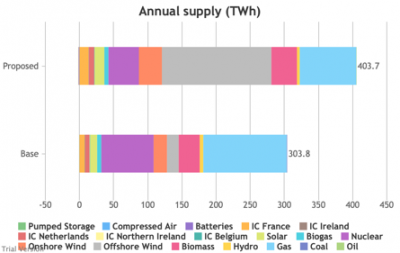

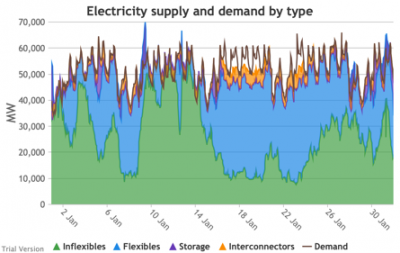

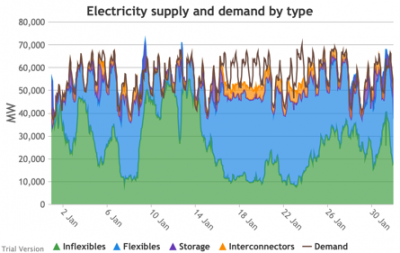

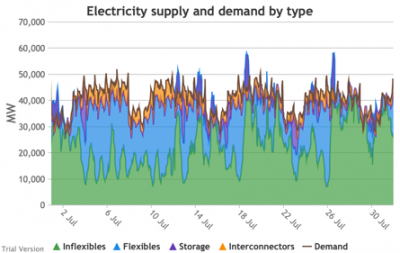

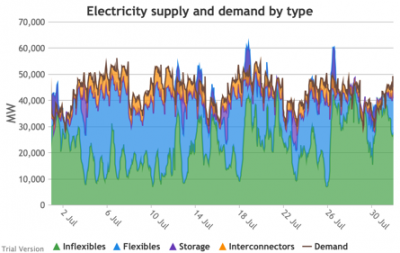

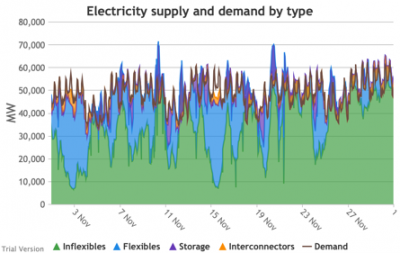

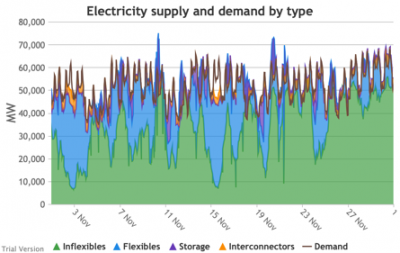

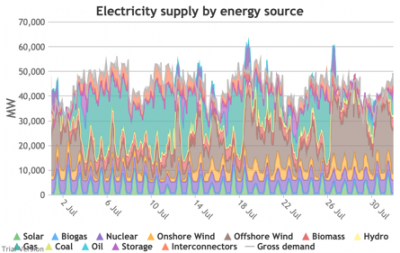

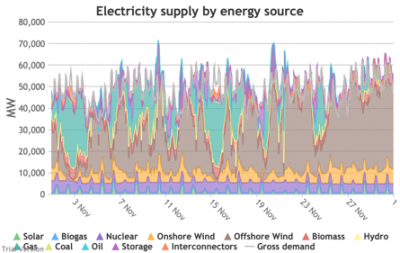

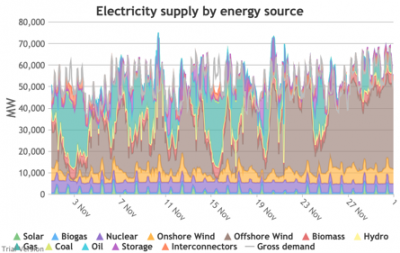

- Electricity supply and demand by type

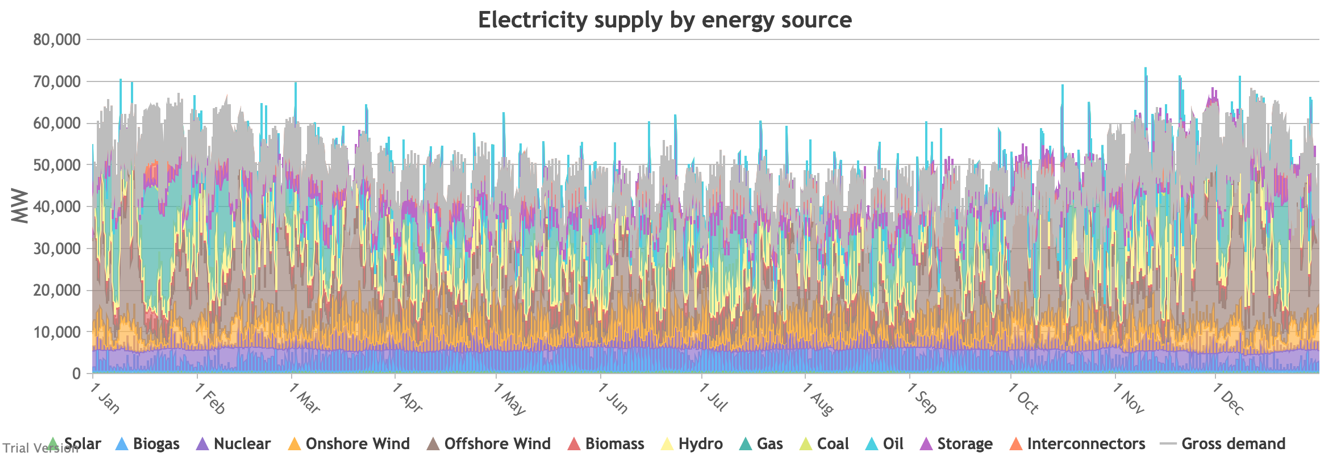

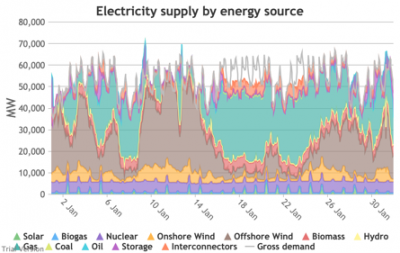

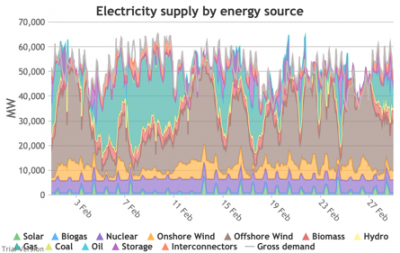

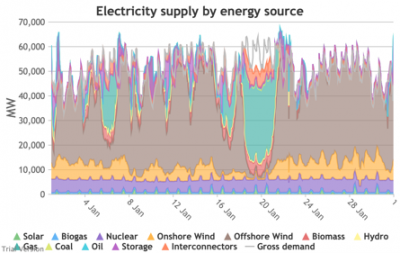

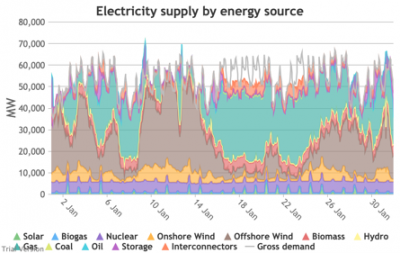

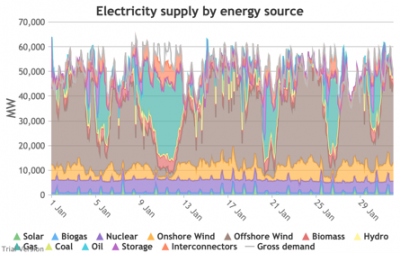

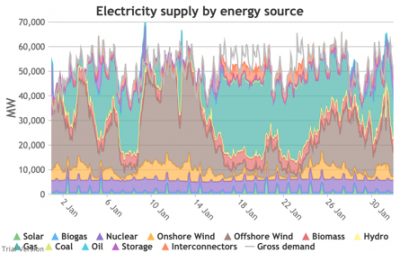

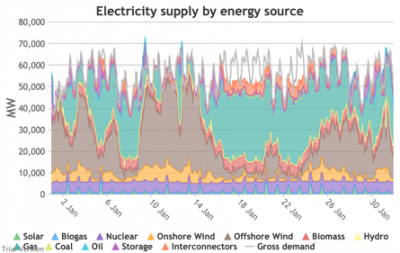

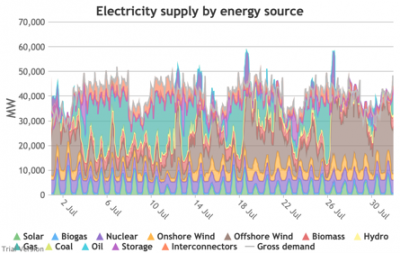

- Electricity supply and demand by source

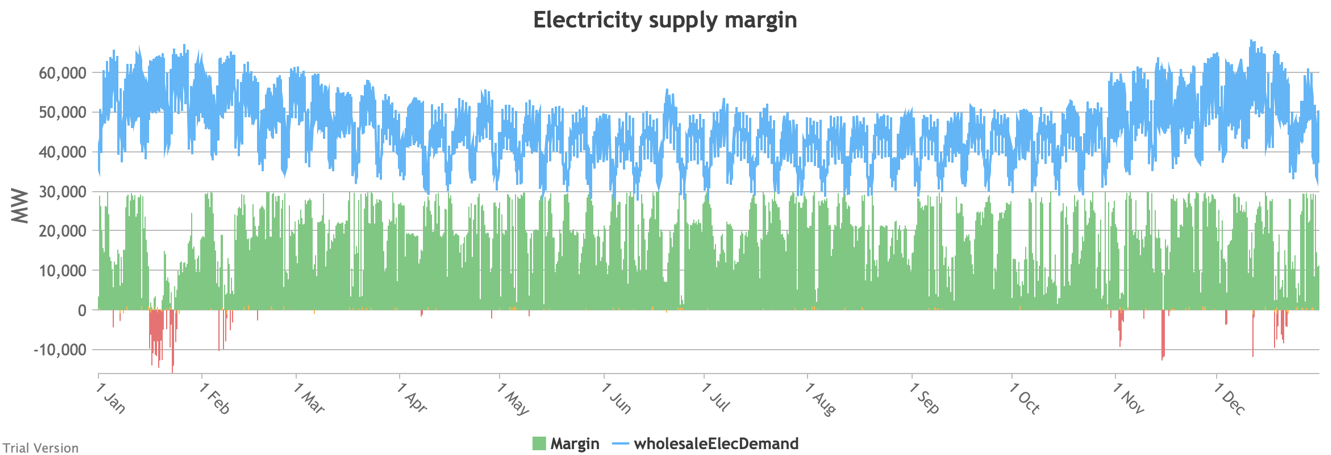

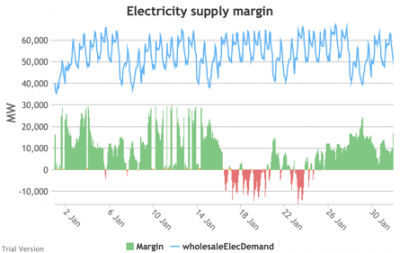

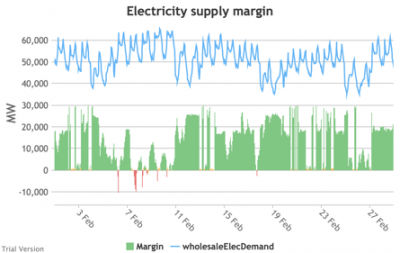

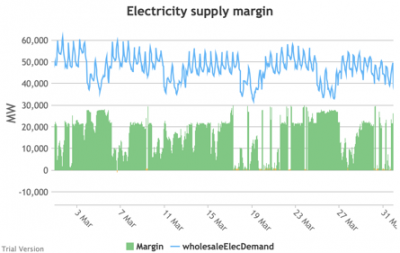

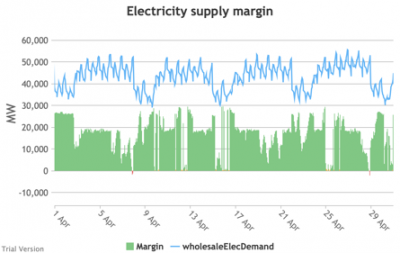

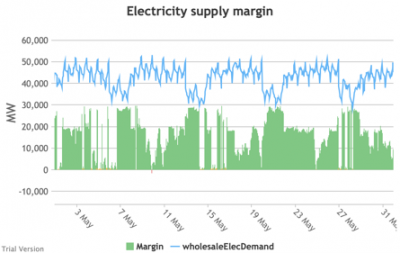

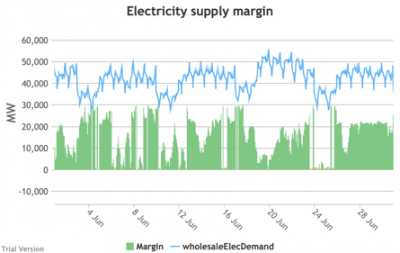

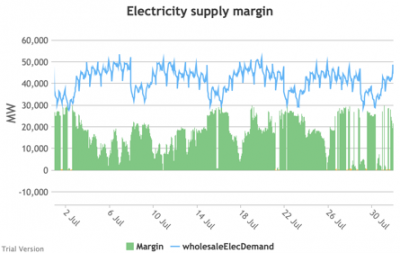

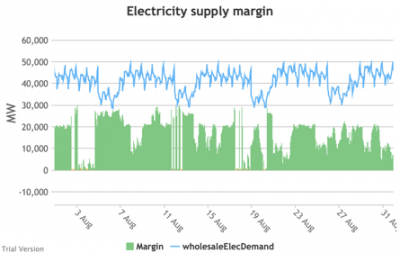

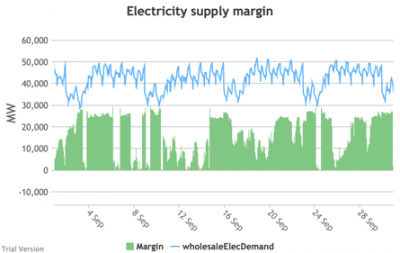

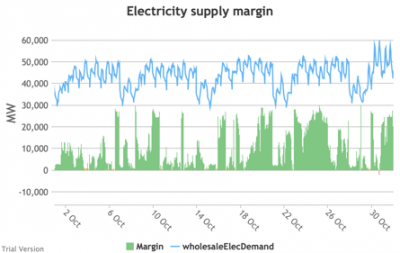

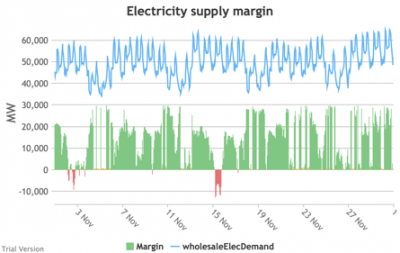

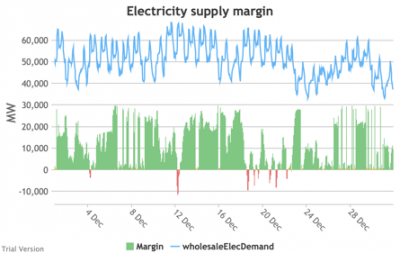

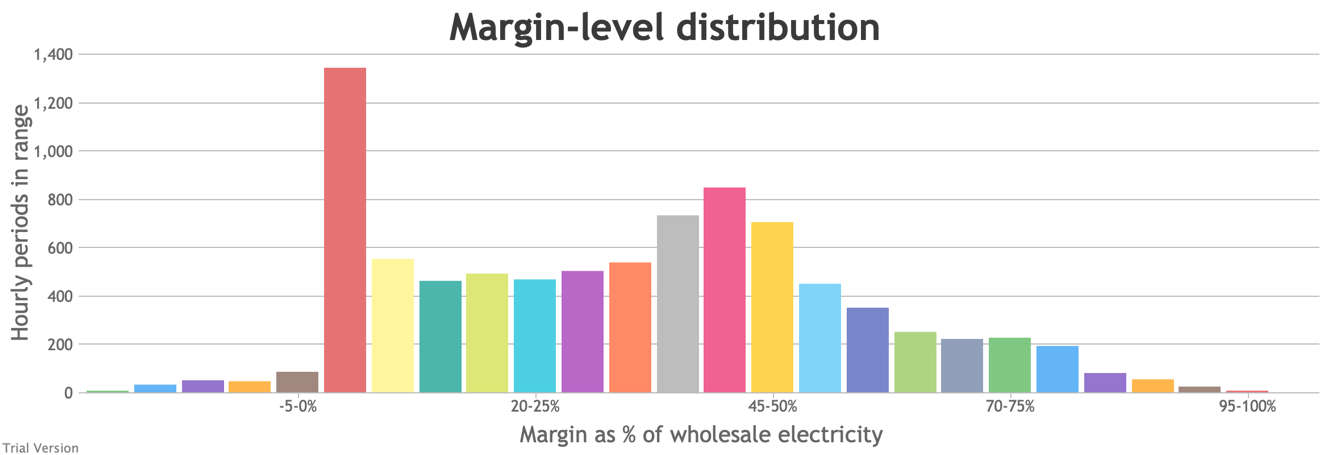

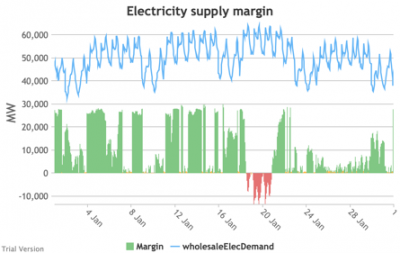

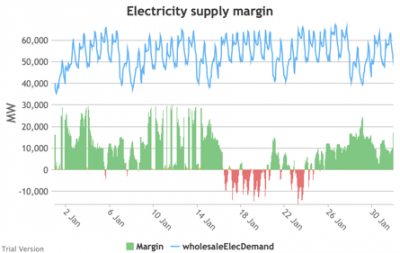

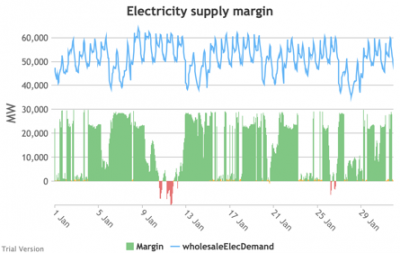

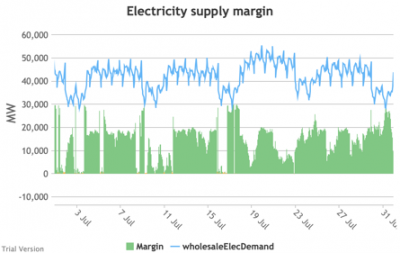

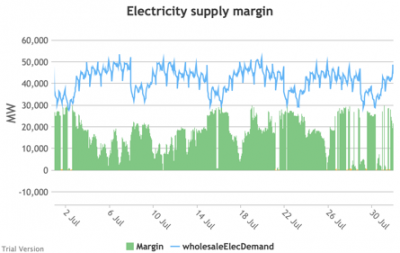

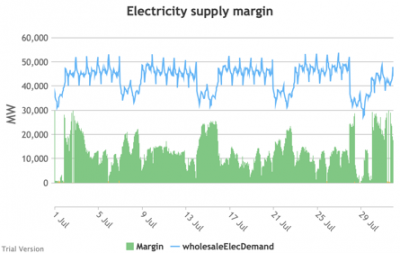

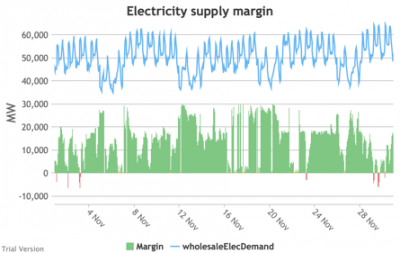

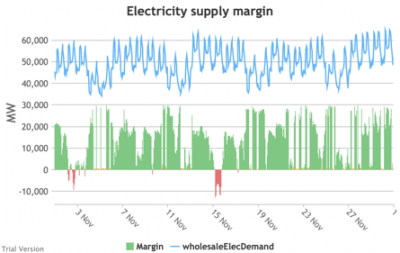

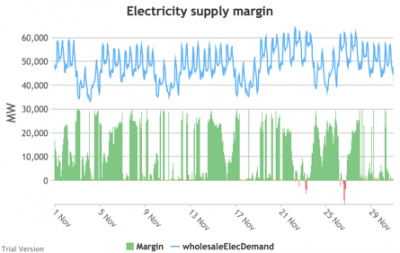

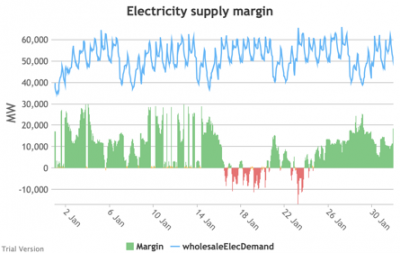

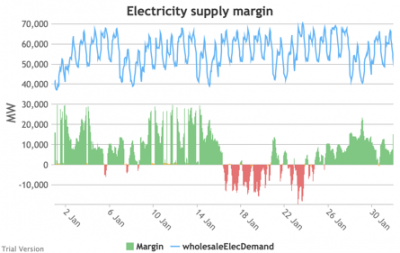

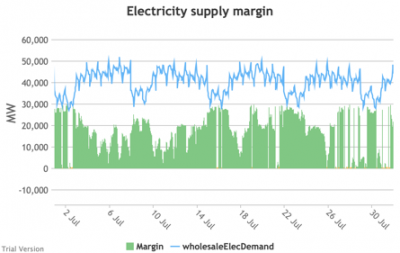

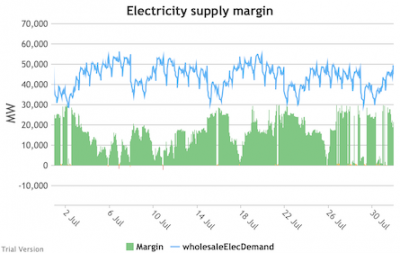

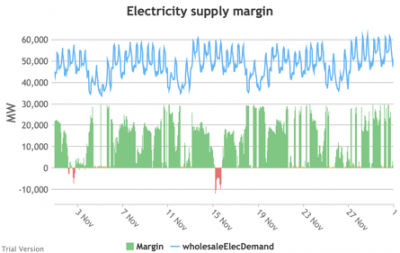

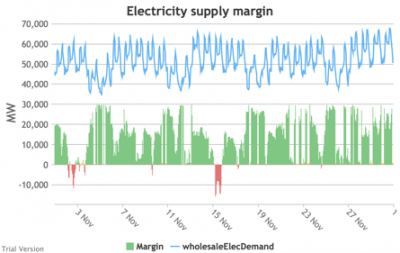

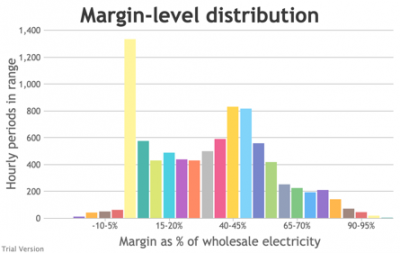

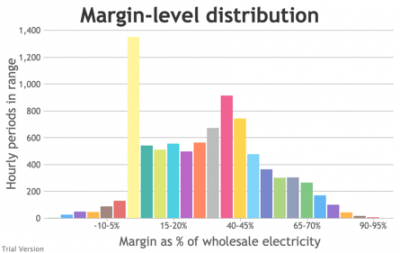

- Electricity supply margin

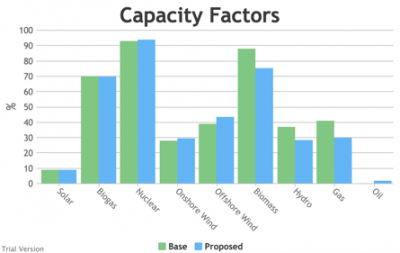

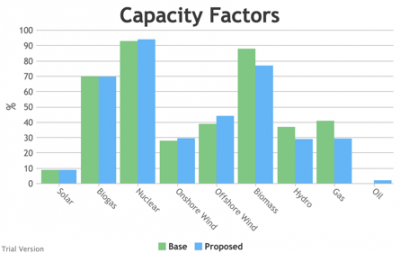

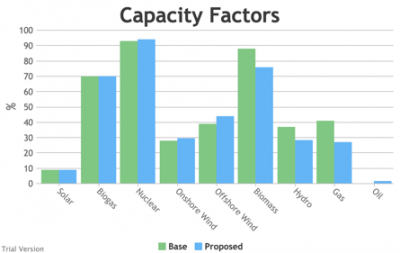

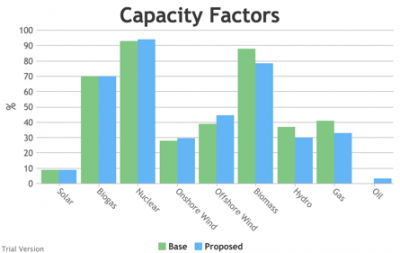

- Electricity generation capacity utilisation (load factors)

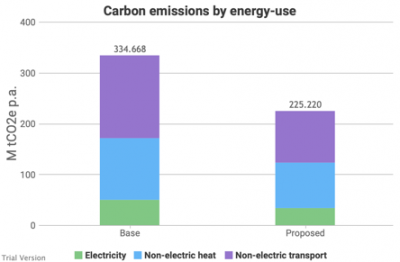

- Carbon

- Cost

- Sensitivities

- Random temporal variation

- Weather variation

- Increasing resilience, reducing demand-shedding

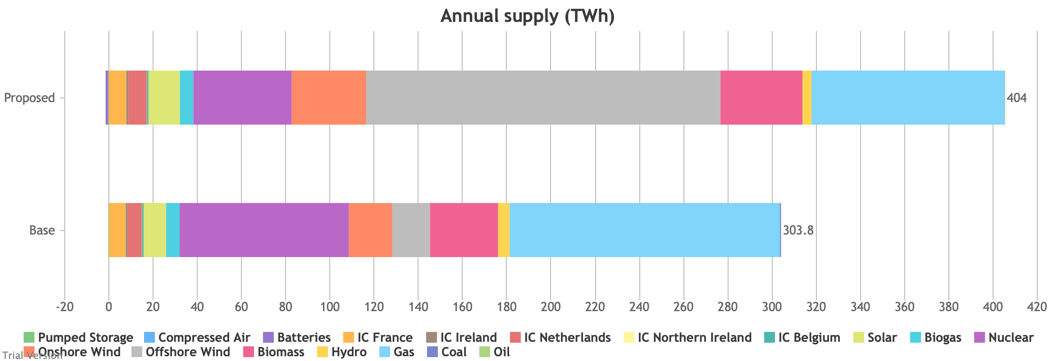

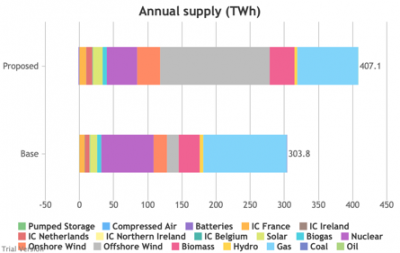

- Pushing on towards Net Zero

- Key sensitivities beyond 2030

- Co-variants

- Technologies not considered

- Electrifying 50% of heat

- Electrifying 75% of road and rail transport

- Eliminating fossil fuels from electricity generation

- Replacing fossil fuels in electricity generation

- Switching from gas/oil to biomass/biogas generation

- Switching from gas/oil to nuclear

- Switching from gas/oil to more wind/solar

- Energy efficiency

- Rebuild with district heating and multiple heat sources

- Conclusion

1. Introduction – Our Experience

1. Introduction – Our Experience Bruno Prior Mon, 14/12/2020 - 00:151.1 Context

- After a century of energy that was (roughly) on tap through the simple expedient of burning the fuels when we needed them, we are returning to an earlier era where balancing energy supply and demand is more challenging.

- We could simply internalise the climate externality through a carbon price, and leave it to the price mechanism to discover the best ways to clear the market. But governments are not generally willing to be so laissez-faire. They are determined to set out how the market should clear, not only in terms of the levels (prices and volumes) but also in terms of the technologies and the contributions that they should make.

- Our experience is that this is a mistake. Summerleaze has been involved in renewable energy for 40 years.

1.2 Pre-privatisation

1.2 Pre-privatisation Bruno Prior Mon, 14/12/2020 - 01:47- We (Summerleaze) installed a heat pump to heat our new offices in the 70s. It minimised energy-consumption and maximised output by delivering so little heat that people wore thick jumpers and rushed to get their work done.

- We worked with Warwick University in the mid 80s to develop technology to purify and liquefy landfill gas to power our trucks. Unfortunately the oil-price collapsed and made the technology uneconomic just as it was reaching fruition. C’est la vie for entrepreneurs. We did not ask for nor deserve to be insulated from that risk. We just wanted to be able to profit where we got the risk right. That was not straightforward in a nationalised energy sector.

- We re-applied our knowledge of landfill gas to the production of electricity, and commissioned our first renewable power station in 1988. This preceded privatisation. We were only able to sell (“spill”) our electricity by the good grace of the local electricity board at a price determined by them.

1.3 The Non-Fossil Fuel Obligation (NFFO)

1.3 The Non-Fossil Fuel Obligation (NFFO) Bruno Prior Mon, 14/12/2020 - 01:56- Privatisation was followed in short order by subsidy for low-carbon electricity in order to prop up nuclear energy. Although we were one of the few existing renewable power stations, we were refused a contract under the first tranche of the Non-Fossil Fuel Obligation (NFFO) because we questioned some of the government’s contract terms. We swallowed our objections for NFFO-2, and our deference was rewarded.

- NFFO was designed as a blind Dutch auction but modified almost immediately to give ministers the power to skew the outcome to favour certain technologies. We argued this was a mistake. The design also rewarded those who travelled most hopefully, not those who were most credible.

- We warned that the consequences would be that (a) ministers would not pick the balance of viable projects as effectively as the market would and (b) the incentives, “winner”-picking and depletion of the low-hanging fruit would lead to increasing proportions of non-viable projects being awarded NFFO contracts.

- The deployment levels fell accordingly, to negligible levels for the favoured technologies by the fifth and final tranche, despite a “will secure” test that supposedly ensured this would not happen. Ministers moved on to the next mechanism.

1.4 The Renewables Obligation (RO)

1.4 The Renewables Obligation (RO) Bruno Prior Mon, 14/12/2020 - 02:01- The Renewables Obligation (RO) replaced NFFO in 2002. Most of the supporting analysis assumed that governments would set the level of the obligation at roughly the level that the market would deliver, aligning the cost with the buy-out price and obligation level. We believed (and advised in consultation) that not only would ministers not be able to anticipate correctly the level of deployment, but that the incentives of the RO would discourage investment if compliance levels were expected to be high. The effect would be that the value of the RO to participants would be higher than expected, as would the cost to consumers (who funded the mechanism) per unit of energy delivered. We invested accordingly and very profitably, when the discrepancy between the levels of obligation and compliance exceeded even our expectations.

- Like NFFO, the RO was initially designed to be technology-neutral but was quickly modified (“banded”) to allow ministers to skew the incentives in favour of more expensive technologies and against cheaper technologies. It is obvious that such a modification increases the cost per MWh delivered, but that was evidently a secondary consideration for ministers, intent on pursuing their industrial policy through an unsuitable mechanism. (The worst way to encourage R&D is through revenue support, as that does little to mitigate the risk that is one of the primary purposes of industrial policy.) We argued against “banding”, but were a voice in the wilderness. Not for the first or last time, we collided with a coalition of interests between:

- politicians (who want magic bullets),

- bureaucrats (whose existence is justified by micro-managing policies),

- academics, consultants and pressure groups (whose influence is maximised by advising governments on ways to supposedly do better than the market), and

- rent-seekers (for whom skewed government incentives are useful insulation against competition).

- Landfill-gas power stations like ours converted gas to electricity at around 40% efficiency. The rest was wasted as heat through the exhaust or radiators.

- We looked for opportunities to utilise the waste heat. It was never economic, because the substantial investment to recover the heat was not justified by the value of the heat plus the value of the carbon displaced by substituting for fossil-fired heating. Policy did not treat the carbon benefit of this form of energy equally to electricity, and consequently low-carbon heat was treated as though it had zero carbon benefit.

- Indeed, the low rate of VAT on domestic energy acted as an effective subsidy for fossil-fired heating in that sector. We argued for technology-neutrality in that regard (which effectively meant a carbon price) as well as between renewable-electricity technologies, but again found no interest in government or elsewhere. The energy went to waste. The UK made almost no progress on decarbonising heat.

- Meanwhile, Sweden decarbonised two-thirds of its heat and half of all its energy, with a carbon tax as its main policy lever. UK governments continued to pat themselves on the back for decarbonising at great expense a few percent of the 20% of our final energy consumption that takes the form of electricity.

- Focusing myopically for two decades on renewable electricity through NFFO, RO and Feed-in Tariffs (FiTs) had taken UK renewables to a magnificent 4% of our energy by the early 2010s. Yet the Office for Budget Responsibility projected a cost of around £10bn/year for environmental levies (mainly costs of renewable electricity) by 2020.

1.5 Contracts for Differences (CfDs)

1.5 Contracts for Differences (CfDs) Bruno Prior Mon, 14/12/2020 - 12:46- So ministers moved on again. The new scheme employed Contracts for Differences (CfDs) to try to drive down the costs of certain technology “winners” (primarily offshore wind) in a similar manner to NFFO.

- It is too early to say for sure how that will work out, but there is an eerie parallel between the early tranches of NFFO and CfDs, which were expensive but largely delivered, and the later tranches, where prices fell below what were widely-regarded as the thresholds for viability, and deployment consequently disappointed.

- Whilst CfDs may be different for reasons that are not apparent to those who have looked critically at the economics of the favoured technologies, NFFO should at least be a warning not to count the chickens (projects commissioned and run profitably for a few years) before the eggs (contract prices and volumes) have hatched.

- CfDs left Summerleaze in the cold, because (a) they were focused on intermittent technologies, and Summerleaze had always preferred to invest in energy that was there when it was needed, and (b) they favoured scales of investment that were mainly achievable by the government’s corporate clients, beyond the resources of most entrepreneurial SMEs.

1.6 Renewable energy entrepreneurs - quo vadis

1.6 Renewable energy entrepreneurs - quo vadis Bruno Prior Mon, 14/12/2020 - 12:48- This is just one of the signals that has persuaded us that there is no longer an opportunity in the sector for businesses that want to back their idiosyncratic judgments. The only way to operate is to try to do what the government wants, whether or not you believe in it.

- Even then, you are likely to be side-swiped by a change of government view (for example, see what happened to the photovoltaic and biomass-heat industries when they were over-incentivised and then over-delivered). Better to tend your garden.

- The main investments in the sector nowadays are by people primarily spending other people’s money.

1.7 Anaerobic Digestion (AD)

1.7 Anaerobic Digestion (AD) Bruno Prior Mon, 14/12/2020 - 12:49- In 2005, Summerleaze bought one of the UK’s first, large anaerobic digestion (AD) plants out of administration. It had gone bust because it suffered a number of disadvantages, most of which were inflicted or exacerbated by state incentives:

- Its NFFO contract obliged it to take 80% animal slurry. Animal slurry produces little gas compared to most AD feedstocks, and pays no gate fee (the price paid to dispose of waste). It was irredeemably uneconomic, and yet a condition of the government’s contract. The project became economic when we broke the NFFO contract and switched the plant to take primarily food waste.

- It had been situated in a remote rural location (sub-optimally for sources of viable feedstock such as food waste) in order to please the government’s rural development agenda (in pursuit of grants). This also meant (significant to later government policy) that it was not viable to connect it to the gas grid.

- Its economic model was predicated partly on a report by a large engineering consultancy that advised that it would be able to pipe its heat to sell in the neighbouring town, Holsworthy. This was also hopelessly uneconomic, particularly in the absence of any mechanism to value low-carbon heat.

- Holsworthy’s economics changed rapidly after we bought it, as government efforts to stimulate the technology delivered more AD capacity than there was viable feedstock to fill it.

- The gate fee went from nearly half of income to a negligible contribution. That raises the energy price required to break even, which increases the cost of the subsidy required. Effectively, over-stimulation increased the cost to consumers of supporting the technology without significantly increasing the amount of energy, which was largely bounded by an inelastic resource.

- Governments were persuaded that this was not the case by “research” commissioned by interest groups. Particularly influential was a 2009 report by Ernst & Young for National Grid, which predicted that by 2020, biogas would make up between 5% and 18% of our gas supplies (nearly half of domestic gas).[1] In the event, it constitutes around 0.7% of our gas, and the industry is running well below the installed capacity for wont of viable feedstock even at that level.

- So of course, the interest groups (such as NG’s successor, Cadent) commission more “research”. Governments are persuaded that straw can yet be turned into gold, and announce plans for more alchemical policy to stimulate biogas.[2]

- For as long as all AD projects received similar levels of support, this was as much a public inefficiency as a commercial threat. But governments decided that they needed to skew the resource-allocation decisions in the directions they judged best, and introduced new or modified support mechanisms (FiTs and RHI) that awarded significantly different levels of support for AD depending on scale, feedstock and technology (e.g. generating electricity or feeding the gas grid).

- This introduced the risk that a new AD plant could setup in competition to our plants (we subsequently opened in Bishops Cleeve a second large AD plant, this time producing biomethane for injection into the gas grid) and out-compete us for the feedstock, not by being more efficient, but simply by gaming the rules invented by government after we had made our investment.

- Government has traditionally been careful about “grandfathering” their support promises, but governments found it impossible or undesirable to understand that these policy decisions were effectively “un-grandfathering” existing investments.

- A succession of governments have made the regime uncertainty so great in renewable energy that the only people who are sanguine about investment in the sector are either (a) those who do not understand the risks (amongst whom it is likely are many of the institutional investors lending on incredibly low coupons to large projects of technologies that are favoured by government but otherwise fundamentally uneconomic), or (b) those who believe they have a strong enough connection with government that they are insulated from the risk.

1.8 Renewable heat

1.8 Renewable heat Bruno Prior Mon, 14/12/2020 - 12:54- From 2007, Summerleaze invested significantly in renewable heat (specifically, the supply of wood pellets for heating), in the belief that even the British government would not be able to ignore for much longer the obvious constraint that they would only be able to decarbonise so far by focusing on the 20% of our energy that is electricity.

- We selected wood pellets because it was the only technology that appeared suitable to supply the quality of heat required by the insulation and plumbing in the average, draughty British building, at the scale required to make material progress in decarbonising heat. One advantage of the UK lagging so far behind was that it was not difficult to see what had worked in other countries that had made progress in this sector. Academics and interest groups promoted all sorts of magic bullets as usual, but in the real world, biomass heat dominated because it was the least challenging substitute for the existing fossil-fired heating systems.

- When the Renewable Heat Incentive (RHI) was introduced, this reality asserted itself again, turbocharged by bad decisions in the design of the scheme (not only in Northern Ireland, but also in Great Britain to only a slightly lesser extent).

- Biomass heat would have dominated anyway without these mistakes, because the suitable applications for the other technologies were more limited than the government’s ivory-tower advisers recognised.

- But the government believed, as usual, that when the market did not behave in the way that their advisers had predicted, it was the market that must be wrong. The incentives must be adjusted until the “right” outcome was adequately incentivised.

- Within a limited budget, getting more of what they wanted also meant getting less of what they didn’t want. So support for biomass heat was “degressed” (i.e. cut) rapidly, while support for the “right” technologies was increased to many times the cost of biomass heat. Biomass went from growing at 70% a year (not difficult from a minimal base that had waited two decades for an opportunity) to grinding to a halt three years later, long before achieving the critical mass to sustain an industry.

- This was predictably not compensated by an offsetting increase in the contributions of the “right” technologies, because the reality was that the costs were higher and the opportunities were scarcer than the government’s “experts” and the industry lobbyists claimed.

- The RHI was flawed in too many ways to count. We advised DECC of the flaws before and after the RHI’s introduction, but as usual, predictions of unintended consequences and perverse incentives were unwelcome and ignored during implementation, and then greeted with great surprise when they materialised (“20:20 hindsight…” “who could have predicted…”). Amongst the flaws were:

- The overall budget: heat is twice the size of the electricity sector, and yet the government judged £1bn to be excessively generous to make rapid progress to catch up in this massive component of our energy, whilst happily signing up to £10bn/year to decarbonise 1/3 of our electricity.

- Given a tight budget, it was important to get the best value possible. But that meant the technology they didn’t particularly want (biomass). So they divvied up the budget as though they would get significant contributions from multiple technologies, despite the fact that some were much more expensive than others, and with widely-varying potential. This effectively ring-fenced a fraction of an inadequate budget for the only technology that could deliver a material contribution for the limited funds, and sterilised other parts of the budget by ring-fencing them for technologies that would not materialise.

- There are substantial economies of scale in most energy technologies. The government once again resorted to “banding” to reflect this, despite its illogicality and counterproductive history in earlier mechanisms.

- In the RHI’s case, this meant classifying projects as “small”, “medium” or “large” and paying significantly higher tariffs for “small” than for “large”. But each band encompassed a wide range with big differences in scale economies. For example, “small biomass” covered anything from a 10kW to a 199 kW boiler, even though the latter was an order of magnitude more cost effective than the former. Support was set at the estimated level required for the average. This was exceedingly generous for the largest sizes within the band, which could consequently enjoy a payback period of 4 years on a scheme that ran for 15. Delivery was therefore heavily skewed to 199 kW boilers, not because they were the prevalent size required (heat demand is generally diffuse and smaller than that) nor the most economic if it were not for the mechanism, but because it was the size that gamed the RHI best.

- The tariff for units over 199 kW was much lower, but the sort of application that needs that much heat is often not difficult to sub-divide. So even where the most efficient solution (barring the RHI) would have been a large boiler, this was often sub-divided into multiple smaller, more expensive boilers serving portions of the heat demand each, because this maximised the RHI. Unfortunately, the flip side was that it minimised the value achieved by the RHI.

- The small-biomass tariff was eventually degressed to lower than the medium-biomass tariff, because of the over-deployment that the structure had stimulated. Medium biomass projects at the top end of their band (999 kW) became the new sweetspot, and took off accordingly. Ironically, many of the best opportunities (e.g. keeping chickens warm) had already been developed as multiple smaller (199 kW) boilers. So rent-seekers had to create heat loads to suit the necessary scale. They realised they could dry their own wood, and get paid to do it. In fact, the support was worth more than the fuel cost to do the drying, so the more they could dry, the more money they could make. They could dry the fuel to feed the boilers to dry the fuel to feed the boilers… The medium biomass band was quickly swamped with such applications, and equally quickly degressed to a non-viable level for new projects. Most of the RHI biomass-heat budget was used up on projects that would never have been designed that way, and many that would not have existed at all, if it were not for the stupidities of the mechanism design. Only a fraction of the money went to genuinely displacing fossil fuels. The main renewable-heat technology with the potential to deliver cost-effectively at scale was wasted and discredited thanks to the terrible design of the RHI.

- This effect could easily have been avoided. In consultation, before and after the RHI’s introduction, we set out how to achieve that. It was eventually recognised in a revision to the RHI’s biomethane tariffs. It could have been implemented across the board from the start if policymakers had the humility to consider that their initial policy designs and knowledge might be imperfect, and that experience of earlier mechanisms might count for something.

- The way to avoid that disaster would have been to pay a high tariff for the first X MWh and then a low tariff for all subsequent MWh. X does not vary by scale. For small projects, X constitutes a high proportion of their output, and the weighted average tariff is therefore high. For large projects, X constitutes a small proportion of their output and the weighted average tariff is therefore low. Mid-sized projects get mid-sized tariffs. There are no thresholds, just a sliding scale, and therefore minimal perverse incentives to target certain sizes. It is not complicated maths, but it seemed to be beyond the comprehension of the RHI’s architects.

- Or alternatively, just pay a flat rate (e.g. 4p/kWh) on the basis that projects should get what they are worth, not what they need. Challenge installers of small projects and expensive technologies to find ways to reduce costs, or accept that they do not represent good value for taxpayers and the environment if they cannot. Encourage the large projects and cheap technologies that offer the best bang for the buck.

- Either approach would be more rational than what we got. That is not hindsight; it was predictable and predicted.

- The best value in renewable heat is from large biomass projects. Because heat is usually fragmented, the opportunities are limited. They require a substantial investment and take a considerable period of time to deliver. They need (a) some value for their carbon because the capital cost is not usually justified otherwise, and (b) policy stability so that investors will commit to the long timescale to deliver the project.

- Unfortunately, practically the day before the RHI was due to launch, the government announced that they had to revise the large biomass tariff, supposedly because they had realised at the last minute that it would fail an EU state-aid test. When the revised tariff was eventually announced, it was half the original level, and inadequate to justify almost any investment under any conditions, let alone with the heightened political risk from the abrupt policy change. Consquently, almost no large biomass heat was delivered until this policy was reversed. Deployment focused on the smaller, more-expensive scales. If a government had set out to sabotage its own policy, it could scarcely have done better.

- Most heat is used in buildings, and most of that is in homes. But in another late announcement, the government delayed the introduction of the Domestic RHI from 2011 to 2014.

- When it launched, the budget for the scheme to cover the largest heat sector (domestic) was a small fraction of the overall budget, which was itself inadequate by comparison to the resources devoted to electricity.

- Successful technologies quickly hit the budget limit and were “degressed” to a tariff level that would deliver little, whilst their contribution was barely large enough to be discernible in the national energy statistics.

- Unsuccessful technologies sterilised part of a budget that was already inadequate to achieve anything significant.

- As fast as the RHI (domestic and non-domestic) encouraged the establishment of businesses to support the nascent demand, it shot them down again when degression pulled the plug on further deployment.

- It quickly became apparent that the design and budget of the RHI would limit its contribution. But the government still had to achieve by 2020 a level of renewables across the economy, not just in electricity, under the Renewable Energy Directive. And inadequate delivery would expose a flank for opponents to attack the government’s green credentials. What should a government do, if it needs to claim good progress but is unwilling to fund it?

- Conveniently, government statisticians “discovered” (twice) that they had been under-estimating the amount of domestic wood-burning that was occurring. By changing the model used to estimate this element (reasonably on the first occasion, and then ludicrously on the second), they could not only radically increase the amount of renewable heat that they could claim, but also keep increasing it every year in proportion to the estimated level of stove sales, without spending a penny.

- There were a few problems with this “model”.

- It required us to believe that four times as much wood-fuel was available as was estimated by the Forestry Commission and the industry.

- It relied on a survey that asked us to believe that approximately 40% of the wood-burning occurred in the summer months, contradicting an earlier part of the survey, in which the respondents had been asked to specify the summer months when they did not much use their fires and stoves.

- It also asked us to believe that almost none of the new stoves replaced old stoves or fires (which would otherwise have had a negative effect on the estimates because renewable heat is measured in terms of the fuel inputs not the heat output and the higher efficiency of new appliances would have implied lower fuel consumption). The source of this assumption was supposedly communication from HETAS and the REA, both of whom confirmed that they had been referring to RHI-type biomass boilers, for which it would be true, not wood stoves, for which it is palpably not true.

- Moreover, if it were true, we would have expected continued increases in the levels of air pollution traceable to domestic wood burning, but such an increase was not occurring according to the careful (and scarcely favourable to wood burning) measurements being carried out by researchers from Kings College London.

- Frankly, it is an obvious, convenient fiction to cover the government’s embarrassment at the inadequacies of its renewable-heat policies. It is so excessive that the hypothetical contribution from this source dwarfs the contribution of the RHI across all technologies.

- But it was not enough. One problem with statistical rather than real delivery is that it does not provide for organic growth. The amount of growth that could be assumed by the most optimistic interpretation was not sufficient to achieve the necessary growth rates in renewable heat.

- So government statisticians miraculously “discovered” another overlooked source of renewable heat: commercial air-conditioners. They suddenly realised that these were sometimes run in reverse to provide heat, and carried out some studies to conclude that (a) the scale was substantial (again, more than the contribution of the RHI), and (b) the efficiency of these units in heating mode was higher than previously thought and conveniently just over the threshold required to qualify as renewable heat.

- The units were re-classified as “Renewable Air-to-Air Heat Pumps” (RAAHPs) and a generous contribution was estimated from them. In a stroke of the pen, they added another 10 TWh of renewable heat to the statistics without delivering a single extra kWh in real life.

- Unfortunately, this statistical adjustment contains no logic to ratchet the figures upwards in subsequent years, so the contribution of heat pumps to renewable heat has actually slid backwards a touch since this adjustment was made. Delivering renewable heat through statistical adjustments is not the best way of encouraging an industry to deliver real projects.

1.9 Renewable hydrogen

1.9 Renewable hydrogen Bruno Prior Mon, 14/12/2020 - 17:47- Another of our investments was in renewable hydrogen, from 2004, before it became trendy and recognised in policy circles. We identified a landfill site near Cambridge with substantial gas production but an impossibly-expensive electricity connection cost (at the time, it was later to change). We developed a hydrogen electrolysis plant powered by renewable electricity from the landfill site as an alternative way of using the energy and to learn about a potentially-promising technology.

- Our experience was that it was much more challenging, technically and economically, than is portrayed by its many current advocates. It was eventually (in 2010) broken up and sold abroad.

- Of course, technology advances and the challenges may be less now, but it is noticeable that many hydrogen proponents are not people who have built and run a hydrogen production plant for long enough to learn about its strengths and weaknesses, but rather equipment sellers, hopeful developers, academics or lobbyists.

1.10 Lessons

1.10 Lessons Bruno Prior Mon, 14/12/2020 - 17:48- This is typical of the development process in an interventionist environment.

- In a healthy economy, entrepreneurs identify opportunities and risk their capital to invest in commercial research and development to test if their judgment was right and identify ways to reduce costs in implementation. If they made a good judgment, they use their knowledge to replicate and profit from their investment, linking the means to make further investments to the track record of making good judgments. If not, they learn and move on.

- In an unhealthy economy, the risk of investing ahead of policy is too great (“regime uncertainty”), and businesses focus on persuading the government to back their favoured solutions before investing in them. The investments are then insulated from competition from alternative solutions because their profitability leans heavily on the subsidy that is available only to the government’s “winners” (“de-risked” to use the popular current euphemism). This reduces the competitive pressure to reduce costs. Indeed, cost reductions can be unwise because governments may see them as a reason to remove support. Best to promise lower costs in the future subject to sufficient support now, for as long as governments believe it. This is unattractive to entrepreneurs, who like to back their own judgment, and hostile to them because (a) government is typically seduced by big promises, and targets solutions that require investment beyond enterpreneurs’ capital resources, and (b) lobbying and influence lean heavily on corporate heft. We may term this the “corporatist”, “crony capitalist”, “anti-entrepreneurial” or “Mazzucato” model.[1]

- The way to avoid the corporatist siren is for governments to recognise the knowledge problem, forsake the winner-picking course that reflects interventionists’ delusions of adequacy, and tie themselves to the mast of a policy to “internalise the carbon externality” that is blind to technology, scale or sector, aka: a carbon tax.

- This has been the recommended option of most economists over the years. In the form of the Carbon Dividend proposal, it is backed by over 3,500 current economists including 28 Nobel Laureates.[2] But it has never in three decades of privatised energy been a contender in a UK government consultation on low-carbon energy policy.

- Each time we have been faced with another proposal for a winner-picking mechanism, we have prefaced our consultation response with a proviso that a carbon tax would be preferable (before addressing the minutiae on which the government is pretending to seek opinions before implementing what it always intended to do), but it is whistling in the wind.

- Some people believe that the UK does enjoy a carbon price, in the form of the EU Emissions Trading Scheme (EU-ETS). In reality, this only covers around half of energy, which roughly coincides with the sectors in which the UK government intervenes through other measures as well, and excludes those sectors in which the UK has historically done very little. It has also been serially undermined by gaming by national governments, resulting in very low prices that reflect the design of the scheme rather than the cost of the externality.

- Our Chairman travelled to Brussels for an early discussion on the EU-ETS. After they had set out how it would work, he said to the room “But they’ll cheat”, meaning national governments would find ways to exaggerate existing emissions and allocate existing rights generously, particularly to “national champions”, so that modest, easily-achievable savings would be sufficient to ensure compliance, thereby undermining the price signal. This has, of course, proved to be the case, but the comment was treated with a combination of horror and ridicule at the time. How could anyone think that policy would work in any way other than that intended?

- That is not a phenomenon exclusively confined to meetings in Brussels. We have been greeted by the same attitude repeatedly in the UK, when we have tried to warn of the likely ways that policy would be gamed, or of the perverse incentives and unintended consequences.

- It shouldn’t be a difficult judgment for politicians to make:

- If I say, “scrap the winner picking and implement a carbon price across all uses, technologies and scales”, I am saying “I believe I can reduce carbon at a lower cost than my competitors”. You don’t have to believe I am altruistic or more expert; just notice that my self-interest is aligned with the interests of taxpayers.

- If my competitor says “my technology may be expensive now, but will be plentiful and cheap in the future, so long as you subsidise me disproportionately for now”, they may believe it, but they don’t have much confidence in it or they would back their long-term cost-effectiveness under a carbon-pricing regime. Governments have no idea if the claims are true, but can apply the judgment of Solomon – if you really believed it, you would be aiming to profit from your special knowledge in a competitive market, not asking for special treatment.

- The proposal is effectively to move risk away from corporations and on to taxpayers, but allow corporations to retain the profits should the cost-savings materialise. Politicians should be wise to “privatised profits, socialised risks” by now. But “de-risking” is all the rage again in corporatist circles of whatever political colour.

- The lesson for Net Zero of energy policy since privatisation (and of our experience as one of the last renewable-energy entrepreneurs surviving from the days of privatisation) is: DON’T DO IT. It assumes even more omniscience than was assumed in earlier, failed energy policies. We know enough about energy to know that it is too complex to plan and manage in this way. But in over 30 years of involvement in renewable energy, we have never been able to overcome the Dunning-Kruger effect in energy policy-making. Those who need to recognise their ignorance are too ignorant to realise it. They continue to implement or recommend policy as though they know enough to pick winners, ignoring not only the limitations of their position but also the evidence of every preceding failed policy.

1.11 A model to end all models

1.11 A model to end all models Bruno Prior Mon, 14/12/2020 - 18:17- We offer below an analysis of the type that ought to be ignored by policymakers, but on which they place most faith: a model of our energy systems.

- The objective of the model is to illustrate where many of the assumptions underlying dirigiste energy policy ignore the devilish details. It is not intended to provide a better guide to dirigisme than the basis of current policy. It is to illustrate that:

- Taking some factors into account that are minimised in the analysis underpinning policy raises serious questions about the conclusions of that analysis, and

- This is still sufficiently imperfect that policy-making should be conducted on a different basis. We should assume that policy-makers cannot overcome the knowledge problem, and harness the tools (decentralisation and discovery, coordinated through the price mechanism) that humanity has evolved over millennia to cope with such complexity and uncertainty.

- What follows is a description of that model. If you know a bit about energy, you should spot many places where the assumptions either conceal significant detail or are subject to a significant amount of uncertainty.

- One problem with uncertainty and complexity is that they are multiplicative. Each assumption may be reasonable and not too uncertain. Each element of the model may be the most reasonable simplification of reality available. But when there are hundreds of assumptions or model-elements, as there inevitably are in a subject as complex as energy, the product of all of them is such uncertainty, imprecision and path-dependency that only a charlatan would portray the outcome as sufficiently certain to provide a useful basis to pick winners. And only a fool would not see through that charlatan’s claims, however many letters they have after their name and however lofty their seat of learning or corporate influence.

2. Design

2. Design Bruno Prior Mon, 14/12/2020 - 21:382.1 Granularity

- If we are to ignore the knowledge problem, then we need a very (some might say: impossibly) sophisticated model. A model based on aggregates will not do. The devil is in the detail. As Taleb’s aphorism goes: never cross a river that is on average 4ft deep. On average, the UK:

- temperature is around 9°C,

- wind speed is around 8.5 knots,

- insolation is around 900 kWh/m²,

- electricity consumption is around 33.3 GW and

- energy consumption is around 183.2 GW.

- But this is not very helpful for designing a system that will meet people’s needs as supply and demand vary. Never trust someone who is recommending energy policy on the basis of aggregate or average figures. They are either ignorant or concealing something.

- The granularity matters. Annual figures may be useless, but monthly or daily figures are not much better. Diurnal variations of supply and demand are significant, and storage is a cost (and scarcely available to date).

- On the other hand, very high frequency (intervals of seconds or a few minutes) is not practical (because the data are not available) and the marginal benefit over an intermediate frequency is small relative to the cost.

- The only frequencies that provide reasonable granularity and alignment with data, without excessive complexity, are either hourly or half-hourly. Although a lot of electricity data are available on a half-hourly basis, most other energy and weather data are not. A great virtue of hourly figures is that power (MW) and energy (MWh) are aligned, minimising the risk of a common error. We decided to implement our model with an hourly granularity.

2.2 Seed data and assumptions

2.2 Seed data and assumptions Bruno Prior Mon, 14/12/2020 - 21:592.2.1 The need for seed data

- An hourly model must do its best to represent a realistic scenario hour by hour. It will need to either accept hourly seed data or generate its own.

- It is not realistic to generate the data. Key factors like weather and demand are neither random nor regular. They are not unrelated but not determinant (e.g. temperature and wind affect demand, but so do other human factors). The output of any model based on artificially-generated data would primarily reflect the assumptions used to generate that data.

- The seed data must be based on historic data to provide a realistic pattern of irregular variability amongst several key components, which creates the challenge to balance supply and demand.

- That historic data must be used raw and not aggregated to produce “typical” figures for each period. The aggregate would not be typical. It would be an average that radically dampened the inter- and intra-temporal variability that represent the key challenge in real-life operation.

- The model must encompass all energy, not just electricity as many previous models have done. Net Zero is about recognising that decarbonisation has to cover a lot more than the electricity sector.

- Many of the favoured solutions (e.g. electrification, hydrogen and bioenergy) create large overlaps between what were previously regarded as largely discrete sectors: electricity, transport, heat and non-energy carbon sources. The model and the seed data need to encompass these overlaps, to allow for the allocation of scarce means between alternative uses.[1]

- Which factors are primarily exogenous and require seed data?

2.2.2 Weather

2.2.2 Weather Bruno Prior Mon, 14/12/2020 - 22:03- The external temperature is the most important factor in the levels of heat demand. But the relationship between temperature and heat demand is revealed primarily by comparing temperatures with the use of the primary heating fuel: gas. Unfortunately, unlike electricity, most gas is not metered on a frequent basis. Two academic studies attempted to overcome this by estimating daily profiles that could be applied to the daily figures for gas-use available from National Grid to generate synthetic granular heat-demand data:

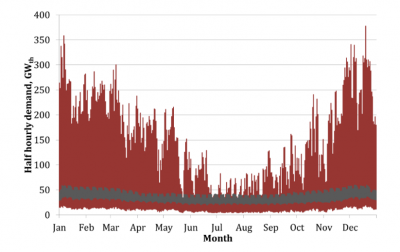

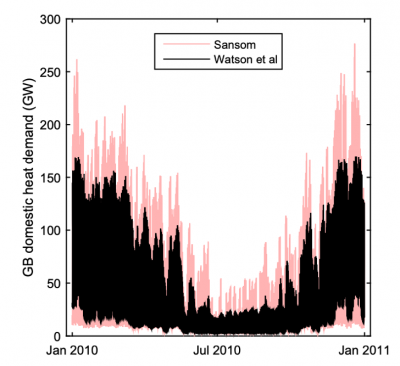

- The ground-breaking research of Robert Sansom at Imperial College London generated the first profile of half-hourly heat demand, reflected in the chart to the right that has become famous in energy-policy circles for illustrating the challenge of matching heat demand to inflexible sources:[1]

-

Recently, Watson, Lomas and Buswell of Loughborough University made some well-founded modifications to Sansom’s model that reduced its “peakiness”.[2] The observation that heat demand would be spread more widely over the day in cold conditions with high demand (rather than simply increased pro rata in each period) is both intuitive and consistent with the large dataset that they used. The difference with Sansom is illustrated in the chart from their paper to the right.

We adopted their “less-peaky” heat-demand profiles to convert National Grid’s daily gas-demand figures into reasonable synthetic hourly figures.[3] The somewhat-flattened profile reduces the balancing challenge, but comparing the two charts above should illustrate that heat demand remains significantly larger and more variable than electricity demand (the grey line in Sansom’s chart).

- Temperature is important not only to the heating demand, but also to the cooling demand. This is currently modest in the UK, but is a key determinant of the demand profile in hotter countries, and is likely to become more significant in the UK if the climate warms and if we wish to reduce the number of excess deaths during hot periods. Data are limited, but we have an estimate of the capacity of non-domestic air-conditioning units (a large proportion of the total) from the work done to estimate the contribution of “RAAHPs” (see above) to our renewable heat. We may assume their output for their primary purpose, cooling, is also significant, but have to adjust for the fact that the estimated heat is not the electricity consumption, but the large figure assumed to be produced on the basis of their heating sCOP. Very roughly, this suggests an equivalent usage in summer that might amount to 5 TWh of electricity (1.7% of total electricity demand). It is unlikely to be more, because even this small amount would be quite prominent in the electricity demand figures for the limited number of periods that require cooling in the UK. We allocate this total (which is an input that can be adjusted in the model) to hourly periods according to the extent the temperature exceeds a threshold temperature for cooling, on the basis of Met Office hourly temperature data.[4] We then subtract these synthesised figures from the electricity demand figures, to estimate the demand for conventional uses (lighting, equipment etc) so that the combined total is consistent with Elexon’s demand figures.

- The wind is another key weather input, as wind power is expected to play such a large part in the UK’s future electricity supplies. Fortunately, half-hourly electricity data are available in a cornucopia of details from Elexon’s website.[5] Wind output from Elexon is better as seed data than any figure for UK wind speeds, as it reflects the reality of where wind farms are actually located, and how their output responds (not linearly) to wind strength.

- UK solar capacity has become large enough for insolation to be another important weather variable. Figures for solar power connected to the transmission network are also available from Elexon, but this is complicated by the fact that the majority of solar is embedded. That has a double effect:

- The available solar figures do not reflect national output, and

- The embedded solar is treated as negative demand and affects Elexon’s demand figures

However, the profile of grid-connected solar output is probably reasonably reflective of the profile of total solar output (although the embedded solar is probably somewhat less optimally positioned on average). So we can use Elexon’s solar figures for the hourly solar profile whilst discarding the absolute figures as only a fraction of the true figure. In our model, we treat solar as one homogeneous lump of capacity (undifferentiated as grid-connected or embedded), and likewise electricity demand as a gross figure exclusive of any embedded power, to minimise complexity. That means that the model figures for electricity demand will not match the metered figures and the figures in national statistics. But reverse-engineering these figures (by applying the solar profile to an estimate of embedded capacity based on subtracting the public figures for total capacity from Elexon’s figures for grid-connected capacity) should be reasonably accurate, and produce the same net effect.

- We do not incorporate other weather factors, such as rainfall, which have some impact (e.g. on hydro output and heat demand). These should be internalised approximately in the figures we use to estimate these components.

[4] We extracted this data while the Met Office had made their APIs freely available to the public, enabling us to download hourly data for their measurement points around the country. Unfortunately, they closed the public access in 2019, which is why our model uses data for the years 2016-2018, which were the years for which we obtained complete datasets before the API was closed.

2.2.3 Energy supply and demand (human behaviour)

2.2.3 Energy supply and demand (human behaviour) Bruno Prior Mon, 14/12/2020 - 22:20- The other key exogenous factor is human behaviour, as reflected in patterns of usage.

- We have already explained how we generate estimates for hourly gas demand. To convert this into heat demand, we need to adjust for the other heat sources. Not all heat sources are used equally for the different uses of heat (e.g. space heating, hot water, cooking and industrial uses). Gas, as the predominant form of space heating in the UK, skews more heavily to space heating than some of the other heat sources. We cannot simply therefore apply the gas figures pro rata to the other technologies.

- One of those heat sources (oil) appears from national statistics to have a similar seasonal profile to gas, and we treat accordingly.

- Another heat source (wood fires and stoves) is used almost exclusively for space heating. The Domestic Wood-Use Survey of 2015 identified that (a) very few fires and stoves had back boilers (i.e. they were limited to space heating) and (b) around 40% of their heat was produced in summer, even though the respondents defined the summer period as the months when they did not burn wood.[1] These two “facts” are irreconcilably conflicting. We choose to believe the credible one: that most appliances do not have back boilers and therefore supply heat according to the profile for space-heating demand that can be extracted from the gas figures, not 40% in summer. This is actually an important factor in reducing the stresses of balancing the system, because wood burning is playing the role in this model that it plays in real life – helping to supplement the primary heat source during the coldest periods, when those primary heat sources would otherwise be under greater pressure.

- The other technologies show much less seasonality in the national statistics. There is not great variation between their quarterly splits, and we treat them homogenously. We estimate the residual hourly heat after subtracting gas, oil and wood’s shares on the above basis, and then divide it for each technology and hour pro rata to that technology’s share of the total and the balance between space heating (highly seasonal) and other heating (much flatter) within those residual figures. This is a broad assumption, but as reasonable a basis to allocate figures that are not available hourly as any other way that we could conceive.

- We apply conversion factors to each heating technology to estimate their fuel-use. This is an important difference from the conventional way of dealing with heat in the national statistics. Heat is traditionally treated as synonymous with the fuel used to produce it, in contrast to electricity, which is measured as the output of the conversion process after losses. The difficulty with treating heat this way is that differences in efficiency between some technologies are significant (e.g. heat pumps at one extreme and wood fires at the other), so one cannot simply switch their fuel consumption from one to the other. But it is an important part of the model to test different contributions from various heating technologies. We therefore reverse-engineer figures for heat outputs, i.e. the heat actually used, not the fuel used to produce it, applying reasonable conversion efficiencies for each technology and the hourly shares described above. The default heat demand figures therefore look smaller than in the national statistics, because they are net of conversion losses. When the model is run, it re-applies the conversion efficiencies to the hourly figures calculated from the seed data and the modeller’s choices, to calculate the usage of each fuel.

- For the electricity technologies (direct heating, air-source and ground-source heat pumps) this fuel usage under the default assumptions is deducted from the total demand figures to estimate conventional demand net of heat (and cooling, see below) in the seed data, so that changes to the use of electric heating can be reflected separately in the total electricity figures.

- Electricity demand is based on Elexon’s figures. Their out-turn figures (INDO and ITSDO) are the longest half-hourly series available. They are imperfect representations of demand, but the best we have for demand upstream and downstream of the transmission network.

- Interconnector flows are also based on Elexon’s data. This is a difficult area because the flows are determined not only by the UK’s needs but also by those of our counterparts at the other ends. Flows may be into the UK because we need the electricity and/or because a neighbour (e.g. France) needs to dump its excess. The best we can do is treat the historical figures as an indication of the elasticity (e.g. high export means either the UK really needed to shed load or the neighbour really needed the imports). We marry this to our model’s generated balance taking into account all the other variables, and assume that flows will reflect a balance of the factors. For example:

- If we were historically exporting strongly in a period but our model predicts under different conditions that we would have a high need to import in that period, we assume that the UK would not choose to export, but the neighbour would have its own requirements that prevented substantial export to us, and treat it as a wash.

- If historical flows were not large up or down in a period, and the model calculates that the UK needs to import or export heavily in that period under different conditions, we assume that the neighbour was not stressed and would be able to accommodate the UK’s requirements.

- If the model predicts that the UK will not be under significant stress in a period, but a neighbour (most often Ireland) was relying heavily on us historically in that period, the model assumes that we will continue to accommodate that.

- Another difficulty of interconnectors is predicting the flows where they are planned with other neighbours for whom we have no historic data. The model accepts as an input the assumed capacity of each of the five existing routes under the conditions being modelled (e.g. the modeller can assume that each interconnector has been expanded or closed). It does not (yet) offer a means to add another interconnector with a different profile because there is no obvious way to generate that profile. This will obviously not mirror the real world when these new interconnectors arrive. It is just one more example of the limitations of modelling. Other models may use assumptions to address this problem, but their output will then be significantly conditioned by their assumptions rather than by the data and the model. Garbage In, Garbage Out.

- We have already covered most of the inflexible generation technologies: onshore and offshore wind and solar. We treat two other technologies as inflexible, i.e. their output is determined by their operation more than by demand.

- Nuclear is the key one. Although it can be varied, its economics mean that it rarely is. It does, however, occasionally experience step changes when one of the units has to shutdown for maintenance. Each unit is so large that these steps are material. We reflect this by using Elexon’s figures for nuclear output to determine nuclear’s output profile in the model.

- Biogas (e.g. anaerobic digestion, sewage gas and landfill gas) also tends to run relatively flat, not because it also couldn’t be varied (storage for a few hours of gas would not be too expensive or technically complex), but because of the incentives created by the subsidy regimes make it uneconomic to do anything other than export as the power is produced. We therefore use Elexon’s figures for this technology in the same way as for nuclear.

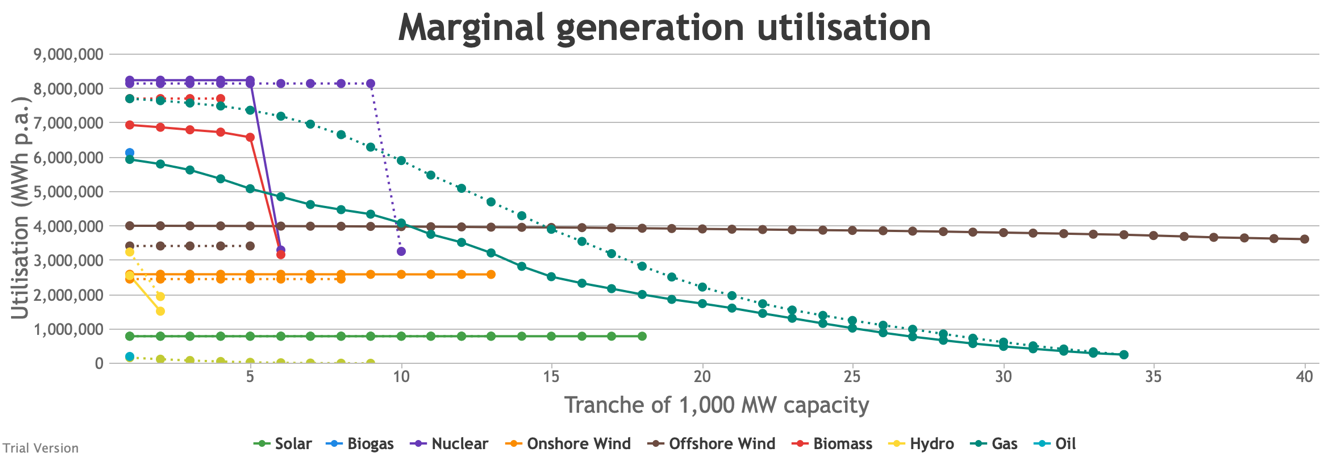

To date, it is so rare for the output of inflexibles to exceed total demand that there is not a great issue of contention. But it has started to occur, and increasing capacity of some of these technologies means that it is likely to become a significant issue. The model therefore needs a method to decide how the output of inflexibles will vary where there is insufficient demand. Our merit order, based on the economics and engineering issues of de-rating and up-rating the technologies and the history of how this has been handled in the relatively rare cases to date is: nuclear, biogas, solar, onshore wind, offshore wind. This is another case where the assumption is highly imperfect (for instance, in reality, it will vary within technology depending whether the projects are embedded or grid-connected) but some method must be chosen, and no other seems superior.

- The other generation technologies are treated as dispatchable, even though some (e.g. solid biomass) have been in a halfway house to date, created by the tension between their incentives (produce baseload to maximise subsidy) and the network requirements (marginal costs are higher than the inflexibles, so when the latter’s output approaches total demand, biomass has to de-rate). Our cost data (covered below) differentiates between capital, flat-operating (£/period) and variable-operating (£/MWh) costs, and the model can therefore estimate marginal costs for the generating technologies treated as dispatchable (gas, oil, coal, solid biomass and hydro). We do not use seed data for these technologies, as their output has to be treated as one of the key ways to balance the inflexible elements of supply and demand.

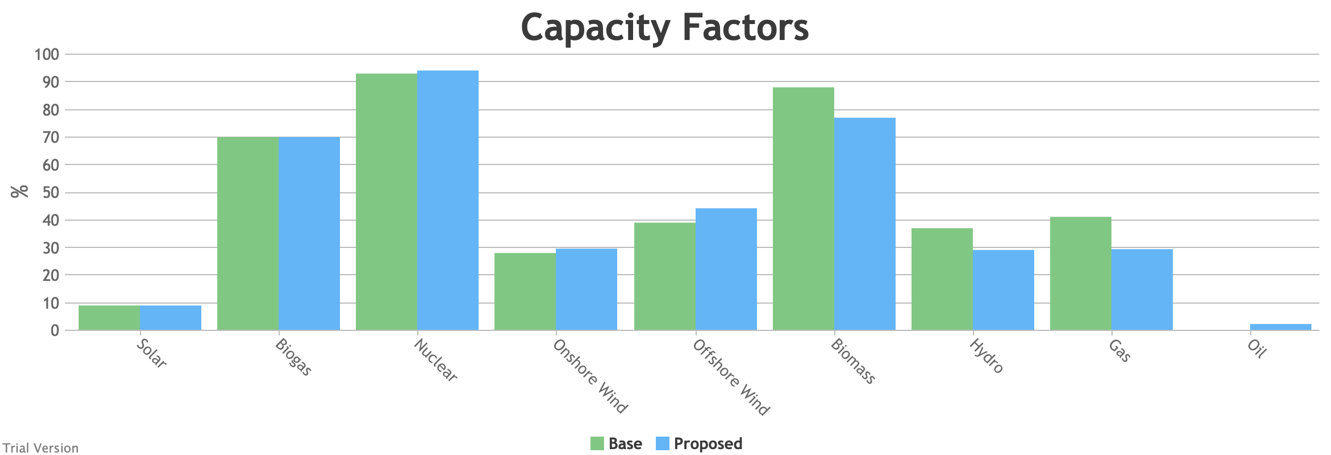

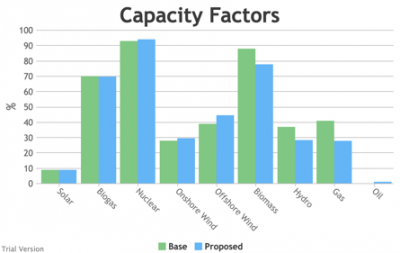

- Large volumes of intermittents mean increasing periods where some output has to be constrained. The subtly-different concepts of “load factor” and “capacity factor” both refer to outcomes, not potential. In order to differentiate between what technologies would deliver unconstrained and what they actually deliver having been constrained, the model uses a concept we have termed “availability factor”, meaning the load factor that they would achieve if they were not constrained. We use this to estimate what each technology would like to supply if not constrained. We then apply constraints according to our assumed merit order. Over a year, the load factor is the constrained availability factor. To allow for technical improvements, we differentiate between the historic availability factor for existing capacity and the availability factor for new capacity. The default availability factors for new capacity of most technologies is materially higher than the historic. They can be varied by the modeller.

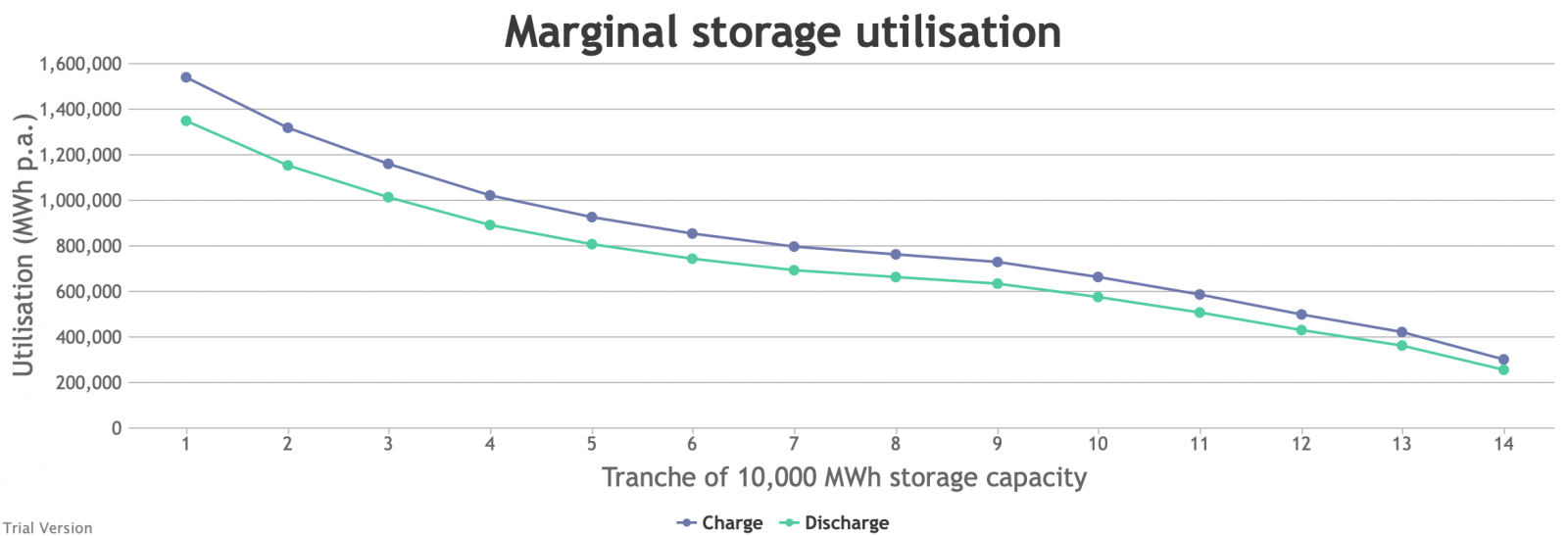

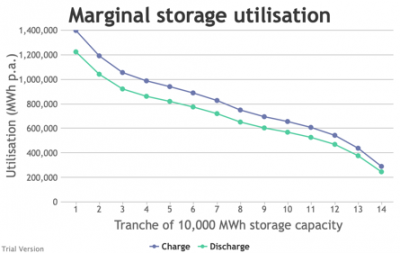

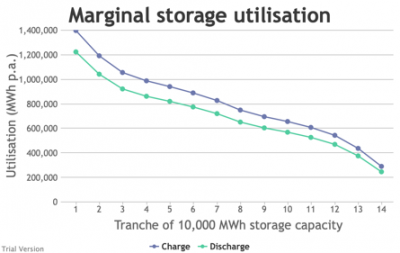

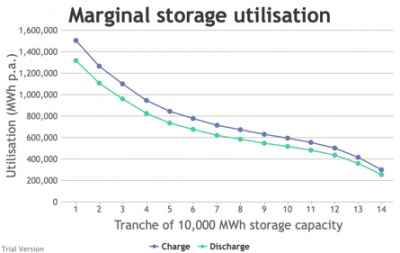

- There is limited storage in our energy systems at present, but this will be one of the key factors in balancing our future energy systems. The model allows the modeller to specify MW, MWh and round-trip efficiency for each of three technologies: pumped-hydro, batteries and compressed-air storage. But no seed data are used beyond reasonable defaults for these values, as these technologies by definition will be used to respond to the balance, which is a key output of the model.

- Transmission and distribution losses are treated as a function, not as an input. Comparison of Elexon’s INDO and ITSDO data reveals that losses are greatest as a proportion when demand is lowest. Losses are calculated by spreading an assumed annual average loss factor (combined for transmission and distribution) across each hourly figure according to a simple formula that reflects this historic behaviour. The loss factor can be varied by the modeller.

- Heat demand is not only a function of the weather, but also of investments that may be made in future, whether in energy-conservation or the construction of more heat uses (e.g. homes or businesses). There has been a tendency in some models in the past to treat improvements in this factor as a way of magically resolving some of the tensions, by treating demand components as inputs for the user to specify.

- We wanted to ensure a more realistic approach, as this is an important and often-abused factor. The model therefore treats the demand from various uses not as an input, but as an output determined by inputs such as:

- the proportion of the existing building stock that has been improved to modern standards with regard to loft, cavity-wall and solid-wall insulation, and glazing, with an indication of the current proportions that are considered easy or difficult to improve, and

- the number of new houses and flats that have been built and the standards to which they have been built.

- the number of existing buildings demolished can also be accommodated by reducing the total figures under the section for existing buildings. The model relies on the modeller to choose realistic figures for the combined number of existing, demolished and new-build buildings. An unrealistic modeller could skew outcomes by assuming that we shall all live five to a flat in future. But they will then have to explain how that is desirable and deliverable in a democracy.

- These calculations rely on seed data for the cost and efficacy of building improvements and standards, drawn from government statistics, set out in a blog piece on the C4CS website.[2]

2.2.4 Costs

2.2.4 Costs Bruno Prior Mon, 14/12/2020 - 22:24- Our generating-cost data are drawn from a number of sources, and incorporate a significant amount of judgment as the information is rarely consistent. We differentiate between the costs of existing capacity and costs of new capacity to allow the modeller to test learning-curve assumptions. In the case of technologies dominated by old installations (nuclear, biomass, hydro and coal), the existing capital costs reflect an estimated book value, as their main use will be to estimate the cost of decommissioning them. For gas, “existing” is assumed to be CCGTs, but “new” is assumed to be OCGTs or similar, for market reasons, and to allow to differentiate within the model.

- The defaults can be adjusted by the modeller. The variable cost incorporates the fuel cost (after conversion losses), and is therefore likely to be an important factor for sensitivity testing.

Technology

Capital (£/kW)

Fixed (£/kW/yr)

Variable (£/MWh)

Existing

New

Existing

New

Existing

New

Solar

1300

1000

10

10

0.05

0.05

Biogas

4000

3500

300

300

-10

-10

Nuclear

1300

6000

150

140

11

10

Onshore wind

1500

1250

30

25

0.05

0.05

Offshore wind

3600

3200

100

65

0.05

0.05

Biomass

200

3500

40

60

90

110

Hydro

100

3200

5

5

0.05

0.05

Gas

500

350

17

10

45

65

Coal

300

1000

10

10

25

25

Oil

300

300

10

10

135

135

- Defaults for transmission/distribution costs provide the basis for estimates of network costs in choices that increase maximum or change total flows. These currently cannot be modified, simply because we have not provided the interface. They are easy to adjust within the model, and we will provide an interface in due course. For now, they are:

Capacity (MW)

Capital (£/kW)

Fixed (£/kW/yr)

Variable (£/MWh)

Existing

New

Existing

New

Existing

New

Existing

New

60000

0

450

1000

100

150

5

6

We do not yet incorporate equivalent costs for the gas network. This is a significant omission that needs correcting.

- Storage costs are based on published claims from a variety of sources. With so little deployment, these figures must be regarded as highly speculative, particularly for compressed-air storage for which there are almost no cost data from the sustained operation of substantial installations. We have naively accepted the developers’ claims for wont of a reasonable alternative approach, but these figures should be treated with great caution until proven in sustained operation. Pumped storage and batteries have more of a track record, but are limited in the UK and (in the latter case) limited at scale across the world. We do not yet know how learning curves would balance against resource pressures if they are widely deployed beyond the already-massive scale expected for transport. Treat with caution, but FWIW, these are our defaults:

Technology

Capital (£/kW)

Capital (£/kWh)

Fixed (£/kW/yr)

Variable (£/MWh)

Existing

New

Existing

New

Existing

New

Existing

New

Pumped storage

15

160

160

1000

10

10

0.1

0.5

Batteries

300

240

300

240

10

5

0.5

0.05

Compressed air

1500

1000

40

30

2

1

0.1

0.05

- Two components of capital cost are given for storage because, unlike other aspects of our energy systems, storage capacity is defined in terms of both power (kW, momentary flow) and energy (kWh, sustained flow). These components are additive in the model; e.g. if the capital cost is £1500/kW and £40/kWh, a storage unit rated at 1 MW and 6 MWh costs £1,740,000.

- As for nuclear, hydro etc above, the capital-cost values for pumped storage are an estimate of the book value/decommissioning cost, as the main use of the figure is to estimate the cost if the units were closed down.

- The variable operating costs do not include round-trip losses, which are calculated separately based on the import and export prices generated by the model and the assumed round-trip efficiency for the technology. These are one of the most significant factors in the economics of storage systems.

- The model assumes each technology is half-full at the start of the year, to allow for some charging or discharging, depending on the initial conditions.

- The supplier’s margin is a significant component of the total energy cost. For electricity, we incorporate the following defaults that cannot currently be modified, based on the Big Six’s Consolidated Segmental Statements. The same comments apply as in the previous section, vis-à-vis the interface and the need for equivalent figures for other fuels. These are total costs to be spread over the whole system. This implies no change in the suppliers’ combined costs if volumes change significantly (e.g. with electrification), which is obviously an unsafe assumption. But there are insufficient data to judge how they might vary, and the magnitudes within a probable range are not so large that this imprecision is likely to weigh heavily on the outcomes. One would expect significant economies of scale from electrification. It is not obvious why there are substantial capital costs in the supply business, but that’s what their accounts say. It’s a large number, but small when amortized.

- Capital cost: £4bn

- Fixed cost: £1.5bn p.a.

- Variable cost: £10/MWh

- We provide defaults for two cost factors that have wide ramifications:

- The Weighted Average Cost of Capital: 8%

- The Cost of Carbon: £50/tCO2e

- The construction and operating costs above do not include a cost of carbon, which is applied separately so it can be seen as a separate component, to compare the costs of the chosen options with their carbon value. That comparison can be viewed two ways if it is not favourable:

- The investment may not be justified by the carbon benefit, or

- The assumed price for carbon is incorrect if necessary investments are not justified by their notional carbon saving.

- If the latter, the modeller can adjust the carbon price accordingly. This will propagate through all aspects that engender a carbon cost/saving.

- The modeller should not adjust the carbon price to suit their favoured technologies and ignore the impact on other technologies whose economics may be improved even more by the change. This should avoid perhaps the most common way that energy-system models produce skewed outcomes: by treating different components as though they have different carbon values. We can argue about the true cost of carbon, but whatever it is, it must apply equally to all emissions or sequestrations of carbon. The climate does not care where the greenhouse gases come from, and how they are engendered makes no difference to the harm that they do.

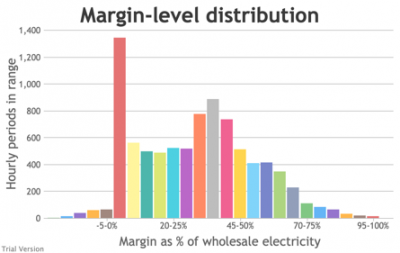

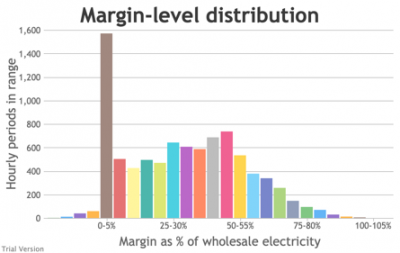

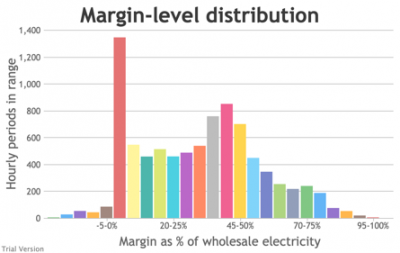

- To convert cost elements into hourly costs/prices, the model assumes that (a) over a year, each technology must cover its costs including the amortized capital cost and cost of money, but (b) the price for output from each technology in each hourly period is a function of (i) its operating costs and (ii) whether the market is long or short (given the technology’s position in the merit order list). The price in long (i.e. over-supplied) conditions is the marginal operating cost. The price in short conditions is the operating cost plus an apportionment of the fixed/capital costs sufficient (when combined over all long-market periods) to achieve (a) over the year. The overall price of electricity in each period is the cost of the marginal technology in that period, given the merit order. For example:

- If the market is short and some gas-fired generation is required, the price of electricity in that period is the price of gas-fired electricity, and as the market is short, the price of gas-fired electricity is its operating cost plus an apportionment of its fixed/capital costs. If gas’s annual load factor is depressed because of high inflexible capacity producing many periods when gas is not required, the cost of gas-fired electricity in the periods when it is required will increase as the fixed/capital costs are spread over fewer periods.

- If the output from inflexible generators exceeds demand, the market is long, and the price is determined by the marginal operating cost of the last technology in the merit order required to meet that demand (typically offshore wind). The marginal operating costs of wind and solar are considered to be very low, so the marginal price of electricity in a long market is typically in this model very low. These are favourable assumptions for the deployment of storage, but hopefully realistic (i.e. the world towards which we are being driven is one in which storage should be able to buy electricity cheaply and sell at a high price).

- We do not take account of any government incentives in the cost calculations. The model is intended to explore the true underlying economics. Government incentives (other than a carbon tax) skew the economics of different technologies significantly. If the pricing generated by this model differs significantly from the real world, this is the biggest reason, and gives a measure of the skew.

2.2.5 Operational assumptions

2.2.5 Operational assumptions Bruno Prior Mon, 14/12/2020 - 22:34- We provide defaults for the existing installed capacity and availability factors. These are based on figures from around the turn of 2018/19, when we were developing this model. In some cases (wind and solar), these figures are materially out of date. They can be adjusted by the modeller. We have chosen not to modify the defaults to the current position because to some extent they are aligned to the hourly seed data, although this is not a major factor as the seed data is used for the profile, not for absolute figures. The model is primarily about the future, so most of these values will be taking fresh inputs anyway, so the starting point is not significant, except that the base case for comparison will be roughly 2016-18, not 2020.

- The current reported capacities of the UK’s five interconnectors (one of them internal, to Northern Ireland) are given as the defaults, but can be modified to model increased interconnection capacity. We do not attempt to model the costs of interconnection. We do not have good data, and the national share of the costs would depend on the balance of import and export, which may vary depending on model assumptions. They arguably lie outside our system boundaries, although if an interconnector were built mainly to satisfy the UK’s needs, we should take account of that cost within overall system costs.

- The only aspect of transport fuel consumption that the model currently attempts to estimate on an hourly basis is that component that is electrified, in order to contribute to the overall electricity figures. It is in the nature of most forms of transport that there is no regular metering of usage, so granular data are not available. Longer-frequency estimates suggest a fairly predictable rhythm to road usage. We estimate hourly usage on the basis of reasonable and simple rules-of-thumb, e.g. usage is higher during the week than at weekend, highest around the rush hours, and marginally higher in summer than winter, but that this will be combined in the case of electric transport with choices to charge off-peak as far as possible.

- The annual usage of fossil fuels and electricity are inputs with defaults based on current usage. They are allocated to hourly periods on the above basis.

- An important constraint is that the model recognises the significant differences in on-vehicle conversion efficiency between Internal Combustion Engines (ICE) and electric motors, and tries to ensure that an adjustment to one is balanced by an equivalent adjustment to the other, such that the total post-conversion energy is not altered by a change to one component, though that total can be adjusted by the modeller. For example, given that electric motors are assumed by default to be 3.4 times more efficient than ICE on average, if we increase electricity’s share of road transport by 1 TWh, we reduce the non-electric component by 3.4 TWh and the total by 2.4 TWh. These default efficiency assumptions can also be varied by the modeller. The default efficiency for electric vehicles may look relatively low to proponents of the technology, but this is intended to reflect not only the efficiency in motion, but also inefficiencies in the charging process. We believe this is more realistic than the utopian figures sometimes used for electric-vehicle efficiency, but the modeller can apply their own assumptions. We have also seen lower efficiencies used by electric-vehicle sceptics.

- Another important assumption in the model is that users have some but not unlimited ability to choose to charge their electric vehicles when other electricity demands are low and prices are then presumably also low, and conversely avoid charging during peak demand periods. In other words, we assume that electric vehicles will provide a significant degree of demand smoothing to help with balancing, but that this will be largely preset according to behavioural patterns and expectations, and not responsive to unexpected system pressures outside expected patterns.

- There is a lot of talk of using vehicle batteries for electricity-system demand responsiveness. It seems to us that, whereas this might be true on the crude basis described above, it is fanciful on a more directed, on-demand basis. For example, few people will choose not to charge their car overnight so that they are unable to go to work the next day, no matter how much the system might need them to. This would have to be imposed against their will, and would be political suicide for any government attempting to instigate the capability. It is not inconceivable in this world of overmighty bureaucracies and misanthropic advisers, but we choose to assume a more benign, if less exactly-managed, world.

2.2.6 Carbon

2.2.6 Carbon Bruno Prior Mon, 14/12/2020 - 22:37- Carbon emissions are another output of the model. They are based on figures for carbon intensity that rely heavily on the UK government’s Greenhouse Gas Conversion Factors and related statistics, although it was necessary to cast the net more widely to encompass online articles for estimates of the construction emissions. These assumptions cannot currently be varied by the modeller. They are also affected by the efficiency assumptions.

- To make a fair comparison between technologies with high energy inputs at the construction phase but low fuel consumption in operation and those that have the reverse pattern, we attempt to take account of both the operating emissions (e.g. fuel combustion) and also the construction emissions. However, we do not attempt to combine them into lifecycle emissions.

- The operating emissions are taken into account within the annual system costs, but the infrastructure emissions are recorded as a separate item, both in their own right and under the investment heading as the carbon element of the capital components of costs. Our assumptions are in the table to the right/below.

|

Technology |

Operating emissions (tCO2e /MWh of fuel consumed) |

Construction /embodied emissions (tCO2e/MW) |

|

Gas |

0.2 |

45 |

|

Oil |

0.25 |

35 |

|

Coal |

0.33 |

380 |

|

Biomass |

0.015 |

380 |

|

Biogas |

0.0002 |

35 |

|

Liquid biofuels |

0.0035 |

- |

|

Hydro |

0 |

500 |

|

Onshore wind |

0 |

730 |

|

Offshore wind |

0 |

840 |

|

Solar |

0 |

1700 |

|

Nuclear |

0 |

1250 |

|

Pumped storage |

- |

40 |

|

Batteries |

- |

40 |

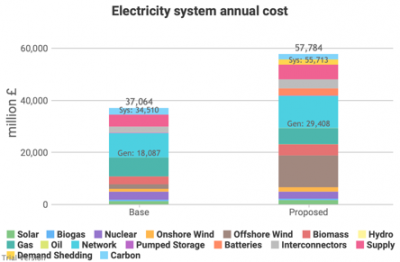

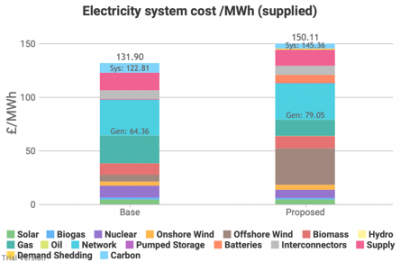

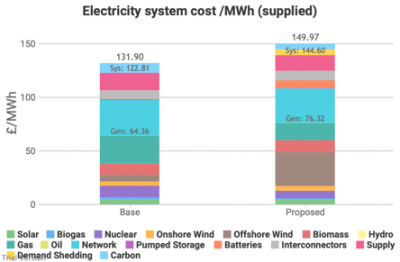

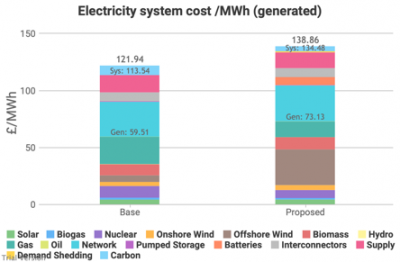

|