Costs

Costs Bruno Prior Thu, 13/02/2020 - 22:08NG/E&Y estimated £10bn for the marginal capital cost of delivering their “stretch” scenario, i.e. the cost above expenditure that would be required anyway for other reasons, for the infrastructure to produce 18.4bn m3 of biomethane p.a.

Most of this was with technology that was not mature enough to obtain a credible market price (gasification and methanation). But the AD component alone was 3,436m m3 p.a. Very roughly, one might expect an AD biomethane facility to cost £2 per m3 p.a. capacity, so the 20% of the “stretch” scenario gas that would be produced by AD would cost around £7bn. Perhaps they imagined that most of this could be covered by the waste disposal income? If so, they were predictably wrong (see below).

Capital cost is only one part of the cost. Unlike wind and solar, the operating cost of biogas production is a material part of the overall costs. The marginal capital cost is therefore a misleading indicator of the overall cost.

NG/E&Y highlighted only two costs: the marginal capital cost, and the gross revenue required. They compared the gross cost per MWh required by biomethane and by offshore wind, and judged them roughly equivalent. This obfuscates some key differences, such as the difference in the (unsupported) wholesale value of the product, and the amount of carbon displaced per MWh. It also implied that the purpose of supporting the technology to the level required to achieve this gross revenue was to cover the modest marginal capital cost of £10bn. They did not overtly translate the proposed level of support into an annual cost.

Their “stretch” total of 18.4bn m3 equates to just under 200 TWh. With gross energy income of around £100/MWh as proposed, this would imply energy revenues of around £20bn p.a.

That includes some wholesale value for the gas, because they were obfuscating the true cost.[1] But one would not realistically project more than £25/MWh (in practice, it has recently fallen below £10/MWh). So around £15bn p.a. of their estimated gross revenue requirement is to support their cost above the competitive value (excluding social benefits) of their product.

If they had highlighted that their “stretch” scenario required support of £15bn annually or (say) £300bn over 20 years, it would have been received very differently than the emphasis on £10bn of net capital cost.

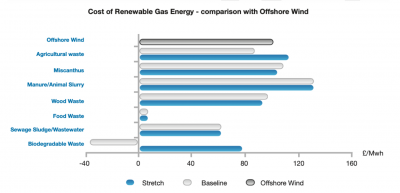

That is assuming their costings were accurate. They were not. The following was their estimate of the costs of producing biomethane from various feedstocks, compared with the cost of offshore wind.

Costing biomethane production from food waste at <£10/MWh implies that it offered substantial returns without any support, which was self-evidently not the case, as it had not happened. They assumed that such a small value was required for the energy because the rest of the costs would be covered by the “gate fee” for disposal of the waste. But:

(a) that gate fee was already applicable in the conditions in which no biomethane plants had been built despite gas values well above £10/MWh, and

(b) a basic understanding of the law of supply and demand could predict what actually happened when the government incentivised even a fraction of the food-waste digestion envisaged by NG/E&Y: competition for the feedstock collapsed the value of the gate fee.

The same point applies to the negative estimate of the cost of using biodegradable waste in the baseline scenario. Even if producers had to pay £35/MWh to dispose of their gas, they expected to get 1bn m3 of biomethane from this source by 2020. Such compelling economics should have meant a significant installed base by 2009, and the baseline 1bn m3 by 2020.

In reality, it was providing nothing in 2009 and still nothing in 2020, given that the main feedstocks for AD were the separate categories of food waste and energy crops, and gasification for grid injection is insignificant. If we are right that this must refer to the slowly-putrescible elements of the waste stream such as paper and board, and therefore requires gasification, no rational analysis could have predicted substantial volumes at negative cost by 2020, given the state of maturity of the required technology in 2009. Synthetic Natural Gas (SNG) was eligible for the RHI biomethane tariff from its introduction in 2011. Support was initially at £68/MWh. It stimulated no significant amount of SNG production.

A price of £130/MWh of biomethane from manure may have been a reasonable guess in 2009. Holsworthy Biogas was not viable at £60/MWh of electricity while running primarily on manure.

With hindsight, it was an underestimate. When the Germans wanted to encourage more farm-scale digestion of this feedstock in 2012, they offered €250/MWh. As the ClimateXChange report noted, the RHI tariffs delivered very little of this, other than modest amounts for co-digestion.

Even if NG/E&Y’s estimate of £130/MWh had been right, it was unjustifiable at that price by any recognised method of comparing the social cost and benefit. NG/E&Y themselves noted that it was more expensive per MWh than offshore wind. They did not add that the carbon intensity of grid electricity at that time was roughly double that of gas and was expected still to be significantly higher than gas in 2020. £130/MWh implies a carbon benefit (from displacing natural gas with this source of biomethane) of around £650/tCO2e. No credible study has proposed a shadow carbon price anywhere near that level for 2020. Any mechanism to encourage this source at this price would have failed a government Economic Impact Assessment.

Their costing of the largely uncostable SNG option is mystifying. Miscanthus and wood waste definitely fall into this category and so too (probably) does biodegradable waste. The technology was not commercially available in 2009, yet they predicted a mid-range price, lower than digesting manure, and similar to the cost of digesting agricultural waste sufficiently in advance of 2020 that it would be massively deployed and competitive by that date. These elements were such a large proportion of the total that a moderate cost-estimate, however fanciful, was essential to the inflated estimate of the potential.

The RHI provided some insight into the true costs and potential when it was implemented. It delivered biomethane mainly from food waste and energy crops. Other feedstocks (besides sewage) were not significantly viable at RHI rates. The success with food waste and energy crops led to the RHI tariffs being degressed. The degression revealed the minimum level of support required to encourage projects of this type. New projects stopped being brought forward as the RHI tariff was reduced to around £40/MWh.[2] Reversing the degression to £50/MWh had little impact, revealing that other issues (i.e. feedstock availability) were now an issue as well as the energy value.[3]

The under-estimation of the cost of these sources of biomethane was a double-edged sword. It was helpful to persuade the government to put its heat-decarbonisation eggs in this basket, because the cost appeared more limited than it really was. But it led the government (and others) to believe that it could get more for its money than it really could.

[1] The wholesale value of each MWh of electricity delivered at a nominal cost of £100/MWh was materially higher than the wholesale value of each MWh of biomethane delivered at a nominal cost of £100/MWh. Focusing on the gross rather than net figure implies a false equivalence. £100/MWh of biomethane represents a higher level of support, even before one compares what each MWh delivers in terms of carbon displacement.

[2] c.£40/MWh for the first 40,000 MWh/yr, £25/MWh for the next 40,000 MWh/yr and £19/MWh for the rest.

[3] £57/MWh for the first trier, £34/MWh for the second tier and £26/MWh for the rest. 3 projects were accredited when the tariffs were raised in May 2018, three more followed in Jun and Dec 2018 and Jun 2019, but this was a dramatically-lower deployment rate than the peak in 2015/16.